Bitcoin is struggling to make gains as an expected low-volume weekend could push price further down. Meanwhile, the increasing number of active Ethereum addresses this year is a testament to the network’s growth.

- Bitcoin (BTC) trading around $18,019 as of 21:00 UTC (4 p.m. ET). Slipping 2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $17,593-$18,404 (CoinDesk 20)

- BTC slightly above its 10-hour moving average but below the 50-hour on the hourly chart, a sideways signal for market technicians.

The price of bitcoin fell to as low as $17,593 Friday, according to CoinDesk 20 data. The price has recovered somewhat, hovering around $18,000 territory, and was at $17,962 as of press time.

“BTC looks like it lost momentum,” said Misha Alefirenko, co-founder of VelvetFormula, a digital asset liquidity provider. “If buyers are not stepping in soon, we may see a testing of the $16,400-$16,900 range over the weekend.”

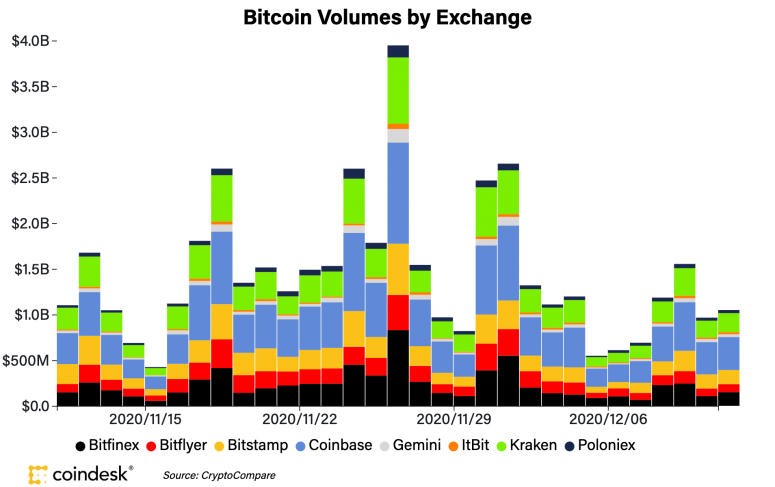

Friday is shaping up to be a better day in terms of volume at over $1 billion total for the eight major exchanges tracked by the CoinDesk 20 as of press time. Thursday’s figure was $965 million. However, weekends almost always have lower volume, such as last weekend’s $578 million daily average, according to CoinDesk 20 data.

“It’s a fairly balanced market at the moment, with the fresh inflows from institutional money met with profit taking from some existing large players as well as increased miners’ hedging,” noted Jean-Marc Bonnefous, partner at investment firm Tellurian Capital.

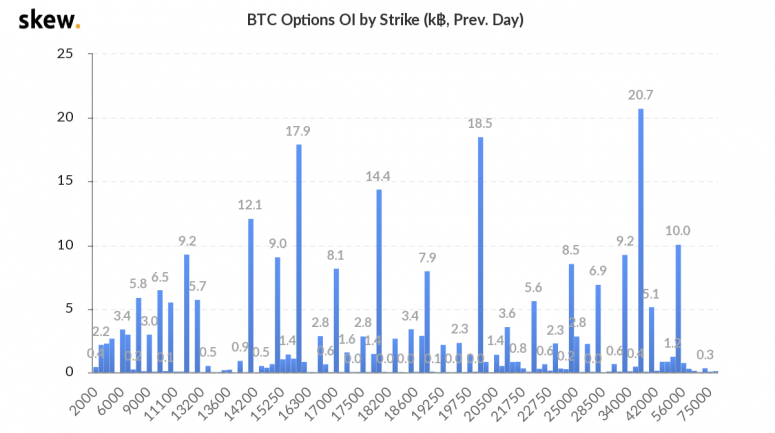

The derivatives market is also a factor, according to Bonnefous. “There is a big concentration around the $16,000 strike for the BTC options expiry on 25th December, which acts as a polarizing target short term,” he said. The $16,000 strike is the third-most popular strike point in the bitcoin options market, based on data from aggregator Skew.

“We are now seeing public companies like MicroStrategy using leverage to acquire a larger position in bitcoin,” said Michael Gord, chief executive officer of quant crypto firm Global Digital Assets.

December doldrums may continue, but many analysts are hyped up about bitcoin’s potential in 2021. “Next year, as annual budgets reopen, I expect a huge surge in demand to enter the industry from enterprises and institutional investors,” Global Digital Asset’s Gord said.

“Macro matters and, in particular, risks surrounding Brexit may rattle equity markets and result in the U.S. dollar potentially strengthening,” said Denis Vinokourov, head of research for crypto brokerage Bequant. Equity markets are down globally Friday on some macroeconomic uncertainty.

- Asia’s Nikkei 225 closed in the red 0.40%, led lower by losses in SoftBank Group, which fell 4.7% in Japan on Friday.

- The FTSE 100 in Europe ended the day slipping 0.80% as Brexit negotiations closed in on a key deadline, leaving investors to sell on the uncertainty.

- The S&P 500 in the United States dipped 0.13% as investors remain unsure regarding the potential for government stimulus to help boost the economy.

“But given bitcoin and broader digital assets this year in the wake of COVID-19 pandemic and U.S. elections, expect bitcoin to show a similar amount of resilience,” added Vinokourov.

Ethereum active addresses uptrend in 2020

Ether (ETH), the second-largest cryptocurrency by market capitalization, was down Friday, trading around $548 and slipping 3.1% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

The number of active addresses on the Ethereum network has increased to 379,249 as of Dec. 10 from 158,039 on Jan. 1, a 140% increase.

Bequant’s Vinokourov told CoinDesk this data, in addition to metrics showing the movement of Ethereum users from centralized exchanges (CeFi) to decentralized exchanges (DeFi), is a huge liquidity opportunity for token economies within that ecosystem.

“The amount of gas fees spent on ETH deposits to centralized exchanges has fallen to less than 1%, as of Dec. 9, from around 26% in late October 2017, according to Glassnode data,” Vinokourov noted. “There is plenty of liquidity in the market. As such, DeFi tokens look particularly attractive even with the recent downside.”

Other markets

Digital assets on the CoinDesk 20 are mostly red Friday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- cosmos (ATOM) + 2.6%

- kyber network (KNC) + 1.1%

Notable losers:

- stellar (XLM) – 5.1%

- litecoin (LTC) – 4.4%

- chainlink (LINK) – 4.3%

Commodities:

- Oil was down 0.82%. Price per barrel of West Texas Intermediate crude: $46.57.

- Gold was in the green 0.14% and at $1,838 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield fell Friday dipping to 0.890 and in the red 1.3%.