Bitcoin’s momentum showed few signs of slowing on Friday, as prices pushed to a new all-time high after blowing through $40,000 for the first time.

In traditional markets, Asian and European shares rose and U.S. stock futures pointed to a higher open, as investors bet that a dismal jobs report expected early Friday from the Labor Department on the December employment situation would strengthen the case for additional economic stimulus. Gold weakened 1.1% to $1,893 an ounce.

Yields on 10-year U.S. Treasury notes jumped Thursday to 1.07%, the highest since March, as traders focused on the potential for faster inflation under a U.S. government controlled by President-elect Joe Biden’s Democratic party, according to the Wall Street Journal.

Market Moves

Bitcoin has climbed more than 40% in the first eight days of 2021 – after a quadrupling in 2020 and doubling in 2019 – and some analysts are turning wary.

“We are very much in speculative bubble territory now, and while I don’t think it’s done, it’s becoming increasingly likely that it’s going to get messy,” Craig Erlam, senior market analyst for the London-based foreign-exchange broker Oanda, wrote in an email. “I previously said I wouldn’t be surprised to see $50,000 before the end of the month and I’m now thinking that was too conservative. The last $10,000 move only took four days. It’s getting silly now.”

First Mover reached out to investors, analysts, executives and one finance professor for their views on whether a correction might be in the future. TL;DR: Yes. Here’s what they said:

- Joe DiPasquale, CEO, BitBull Capital, a cryptocurrency-focused hedge fund. He says Bitcoin’s “has been and remains extremely volatile.” As recently as Monday, he noted, after prices had climbed to a new all-time high, they tumbled almost $7,000. “What causes this is that people can use lots of leverage, so they can easily get washed out.” He sees a correction as possible, though there appear to be plenty of interested buyers around $28,000, so that might level might function like a price support barring any major news that might send prices crashing. What might that be? A forceful move by regulators to impose stiff anti-money-laundering rules on merchants, raising the threat of prosecution or forfeiture if bitcoin can be traced back to illicit proceeds. That might scare off new buyers.

- Gavin Smith, CEO of the digital-asset firm Panxora. According to Smith, there hasn’t been a single year since 2013 when prices have not fallen at least 25% from a high point reached earlier in that year. “Before that it would move so much up and down that you can’t really draw any analysis.” He said he wouldn’t be surprised to see bitcoin prices rise to $70,000 or $80,000, nor if a setback of 40% were to materialize. Medium term, he’s bullish: “Over a three-year period, this is a great asset.” Over the long term, there’s a risk that technological developments could overtake bitcoin. “Even with quantum computing, there’s nothing on the horizon that indicates that could happen,” he says, “but it’s always dangerous to completely ignore the risk.”

- Mike Venuto, co-portfolio manager of the Amplify Transformational Data Sharing exchange-traded fund, which invests in blockchain-related stocks. Will bitcoin crash? “People are going to ask this, because the last time we had a rally like this, it did crash.” He sees bitcoin prices rallying two to three times from their current level before falling back to about where they are now. That would imply a two-thirds retracement from that hypothetically new all-time high. “What’ll cause a crash more likely is overexuberance on the upside. I don’t think we’re there yet.” He says he estimates bitcoin’s fundamental value, based on the current size of the network, to be “somewhere between $40,000 and $50,000,” though that could increase over time.

- Denis Vinokourov, head of research for the cryptocurrency prime broker Bequant. “There will be swings, and yes, the swings will be wild,” he says. “You have a lot of retail flow that tends to panic.” He sees prices going up, in the long term, at least partly based on the bullish expectations of big Wall Street firms. “Can it go to $4,000? Yes.” One potential trigger for a rapid sell-off could be any actions brought by authorities against tether (USDT), a privately issued, dollar-linked digital token known as a “stablecoin” that has become a key source of liquidity in digital-asset markets. New York State prosecutors are currently battling Tether in court due to its finances.

- James Angel, Georgetown University finance professor. “The history of financial markets is the history of bubbles, where investors get carried away with enthusiasm and they bid the prices of certain assets to levels far above their fundamental values,” Angel says. He notes that authorities could move to crimp the bitcoin rally if they start to get worried that it’s becoming a threat. “Almost everybody who tries to start their own money does so in competition with a national currency, and it usually gets shoved aside by regulators.”

- Sui Chung, CEO of CF Benchmarks, a cryptocurrency provider. “Bitcoin passing the $40,000 milestone shows the market still sees upside in the cryptocurrency market. While we’re currently seeing an unequivocal expression in the market’s bullish sentiment, a correction could well be on the horizon. But this is a natural part of market mechanics. While it may dampen near-term enthusiasm, it will ensure future price rises remain grounded.”

- Guy Hirsch, managing director for the U.S. at the trading platform eToro. “There is likely to be profit taking along the way, causing temporary dips (which are of course magnified with bitcoin, relative to traditional assets) but, given the extraordinary amounts of adoption by institutions, it would be a surprise if bitcoin dropped below $20,000 any time soon – though I would caveat this to say that we are monitoring proposed regulatory measures and the posture of the new Administration towards crypto to assess if they would have an adverse impact on institutional adoption of crypto assets.”

– Bradley Keoun and Muyao Shen

Bitcoin Watch

U.S. President-elect Joe Biden’s Democratic party narrowly triumphed in the state of Georgia’s special Senate elections earlier this week, wresting control of the upper legislative chamber from outgoing President Donald Trump’s Republicans. With the lower chamber also under Democratic control, Biden and party leaders could have more room to implement policies.

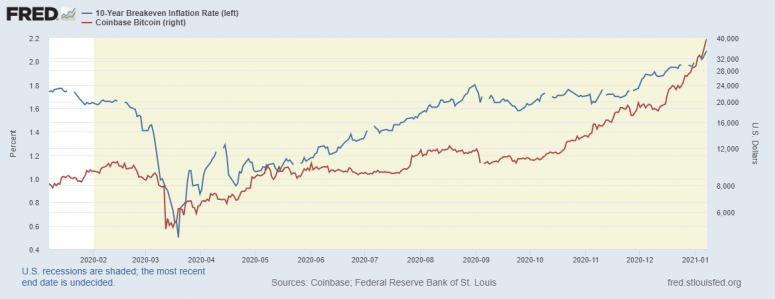

Analysts at UBS Bank say the unified government houses could smooth the path to more fiscal stimulus. According to an Axios report, Biden is considering a two-pronged stimulus effort in the form of $2,000 checks for Americans and a tax and infrastructure spending package worth $3 trillion. The new fiscal stimulus is expected to boost inflation, weaken the U.S. dollar and bring more buyers for scare assets such as bitcoin and gold.

Alex Melikhov, CEO and founder of Equilibrium and the EOSDT stablecoin, told CoinDesk that Biden’s stimulus would inject more liquidity into markets and likely fuel further bitcoin price rises.

The leading cryptocurrency is already in a strong bull market, courtesy of the inflation-boosting measures adopted by the Federal Reserve and the U.S. government over the past 10 months to counter the coronavirus-induced slowdown. These measures have pushed institutions to seek investments that offer a hedge against inflation.

Bitcoin prices have risen from $10,000 to record highs pushed to a new all-time high in the past four months, with public-listed companies such as Microstrategy buying bitcoin to preserve the value of their treasury reserves. That trend could gather pace, as predicted by JPMorgan, with Biden’s additional fiscal stimulus and the Federal Reserve’s continued easing.

“The Biden stimulus may add an extra jolt to bitcoin’s price, but nothing more than pushing along a barreling freight train,” Jehan Chu, managing partner at Hong Kong-based crypto investment firm Kenetic Capital, told CoinDesk.

– Omkar Godbole

What’s Hot

65K comments and counting: Crypto industry fights ‘arbitrary’ Treasury rule (CoinDesk)

Bitcoin “rich list” rebounds to all-time high (CoinDesk)

CoinDesk climbs back up crypto rankings with near 50% rise (CoinDesk)

Grayscale, provider of bitcoin trust, promotes Sonnenshein to CEO, plans to double staff in 2021, sees interest from pension funds and endowments (CoinDesk, Bloomberg)

BitMEX exchange says all users are now verified, months after U.S. prosecutors, regulators bring charges against principals over unregistered trading (CoinDesk)

Analogs

The latest on the economy and traditional finance

December jobs report from U.S. Labor Department is projected to show that the unemployment rate increased for the first time in eight months; economists see nonfarm payrolls growing by 50,000; report from Labor Department is due at 8:30 NY time (13:30 UTC) (jobs report).

Blackstone’s Byron Wien predicts yields on 10-year U.S. Treasury notes will climb to 2%, from just over 1% now, as Federal Reserve maintains accommodative monetary policies (Bloomberg)

U.S. Treasury Department launches $25B emergency rental-assistance program (Treasury Department)