The Democratic Party narrowly triumphed in the special Senate elections in the state of Georgia earlier this week, wresting control of the U.S. Senate from the Republicans. As such, the Democratic-controlled House of Representatives now has more freedom to implement its economic policies.

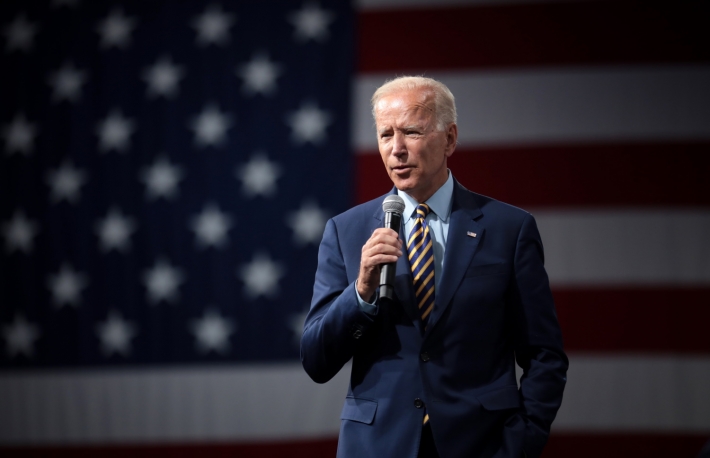

Analysts at UBS Bank believe the unified government legislature will smooth the path to more fiscal stimulus. According to an Axios report, President-elect Joe Biden is considering a two-pronged stimulus effort in the form of $2,000 checks for Americans and a tax and infrastructure spending package worth $3 trillion.

The new fiscal stimulus is expected to boost inflation, weaken the U.S. dollar and bring more buyers for scare assets such as bitcoin and gold.

Alex Melikhov, CEO and founder of Equilibrium and the EOSDT stablecoin, told CoinDesk the extra stimulus would inject more liquidity into markets and likely fuel further bitcoin price rises.

The leading cryptocurrency is already in a strong bull market, courtesy of the inflation-boosting measures adopted by the Federal Reserve and the U.S. government over the past 10 months to counter the coronavirus-induced slowdown. These measures have pushed institutions to seek investments that offer a hedge against inflation.

Bitcoin prices have risen from $10,000 to record highs above $41,000 in the past four months, with publicly listed companies such as MicroStrategy buying bitcoin to preserve the value of their treasury reserves. That trend could gather pace, as predicted by JPMorgan, with Biden’s additional fiscal stimulus and the Federal Reserve’s continued easing.

“The Biden stimulus may add an extra jolt to bitcoin’s price, but nothing more than pushing along a barreling freight train,” Jehan Chu, managing partner at Hong Kong-based crypto investment firm Kenetic Capital, told CoinDesk.

The U.S. central bank is unlikely to unwind or scale back its $120 billion-per-month asset-purchase program any time soon and is committed to keeping interest rates at record lows for sometime after inflation has risen above its 2% target.

Inflation expected

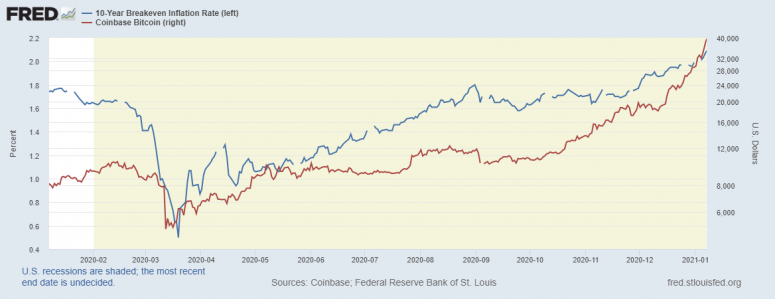

Market-based measures of inflation have begun factoring in a potential stimulus-driven rise in price pressures in the economy. The 10-year breakeven rate, which represents how the bond market foresees long-term inflation, rose to 2.09% on Thursday, the highest level in over two years, according to St. Louis Federal Reserve.

The breakeven rate bottomed out near 0.5% in March 2020 and has been rising ever since. Bitcoin has pretty much mimicked the ascent in inflation expectations over the past 10 months.

The dollar index, which tracks the greenback’s value against major currencies, is also extending its 2020 decline on expectations for additional fiscal stimulus. The index fell to a 33-month low of 89.21 earlier this week, while gold, a traditional inflation hedge, rallied to two-month highs near $1,960 per ounce.

Alongside all this, bitcoin has gained over 40% since the start of the year just eight days ago. The cryptocurrency set yet another new record high of $41,026 earlier today.

“Traders are looking toward dollar weakness that would correlate to further upside in bitcoin,” Matthew Dibb, co-founder, and COO of Stack Funds, told CoinDesk. “Dips, if any, are likely to be short-lived, with technical indicators suggesting little signs of prices nearing a bull market peak.”

“The crypto market will eat [Biden’s new stimulus] up,” he said.