The Bitcoin price (BTC) is hovering under $19,500 again as whales in Asia continue to sell aggressively. On-chain analysts say that the $18,500 to $19,500 is a “no trading zone” until whale inflows subside.Ki Young Ju, the CEO of CryptoQuant, said:

“For me, 18.5k-19.5k is no trading zone. $BTC will break $20k this year eventually, but I’m just normal long(1x) here since lots of fake-outs due to whales. Will punt another generation(10x) long when the market is silent — fewer exchange inflows and less trading volume.”

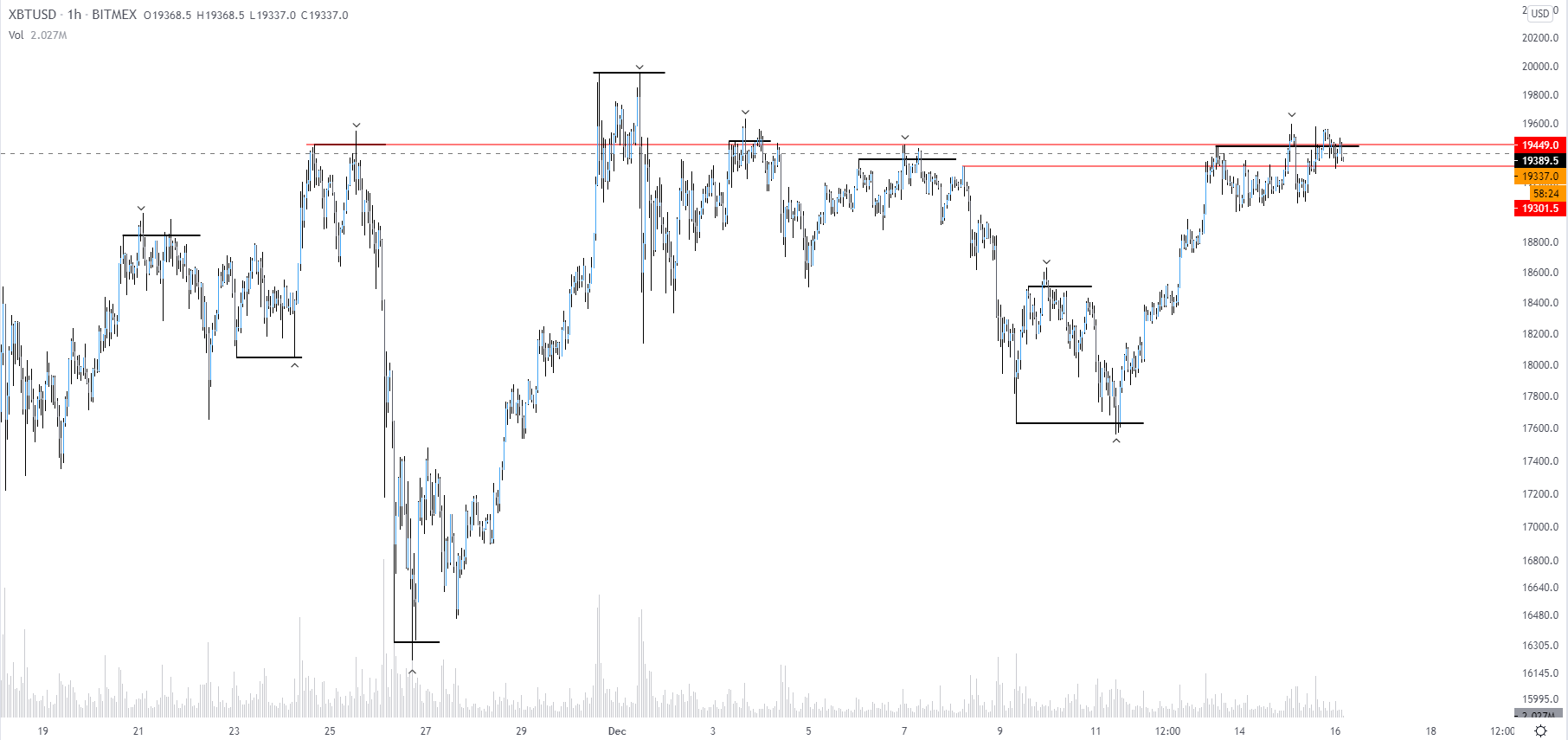

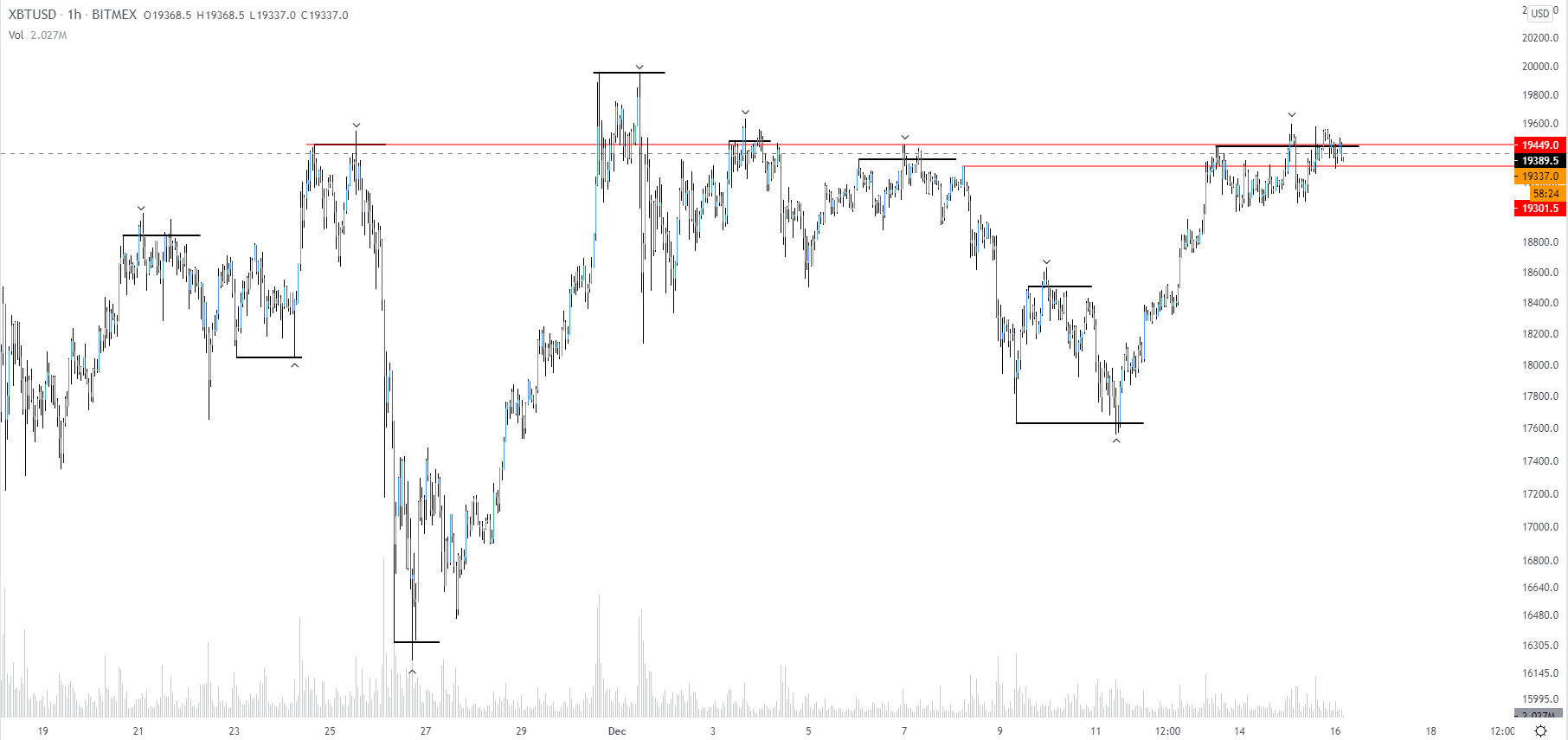

There are two key reasons why analysts are cautious about Bitcoin as it struggles to break out of $19,600. First, the high number of BTC deposits into exchanges by whales suggest high selling pressure in the market. Second, the $19,600 level has become a heavy resistance area.

“Market keeps flip flopping around this level, failing to breakout with a clean swing failure pattern Notion of caution is warranted – clear 19.6 would invalidate that caution.”

What does this mean for the market?There is significant uncertainty around the short-term price cycle of Bitcoin. Until BTC breaks $19,600 with strong volume, the lack of clarity around BTC would likely remain.If this trend continues, it could have a negative impact on large market cap altcoins.Altcoins typically mimic the price trend of Bitcoin with intensified movements to both the upside and downside.Hence, when Bitcoin rises, altcoins rally strongly, but when BTC falls, they see a sharp pullback.The problem for altcoins is that when Bitcoin stays within a tight range, it sees large downside movements but limited uptrends.As CryptoSlate previously reported, technical analysts expect altcoins, like Ethereum, to outperform Bitcoin in the next bull cycle.However, this is conditional in that it would first require BTC to break out and kickstart a convincing rally.