Bitcoin’s price recovered quickly from Monday’s small market sell-off, approaching a new resistant level at $24,000 Tuesday. Traders and analysts said it is because demand has continued to rise despite minor negative market movement.

- Bitcoin (BTC) trading around $23,433.85 as of 21:00 UTC (4 p.m. ET). Gaining 2.64% over the previous 24 hours.

- Bitcoin’s 24-hour range: $22,384.13-$23,629.40 (CoinDesk 20)

- BTC above its 10-hour and 50-hour averages on the hourly chart, a bullish signal for market technicians.

There were few reactions from the market on Monday’s sharp drop to Tuesday’s fast recovery.

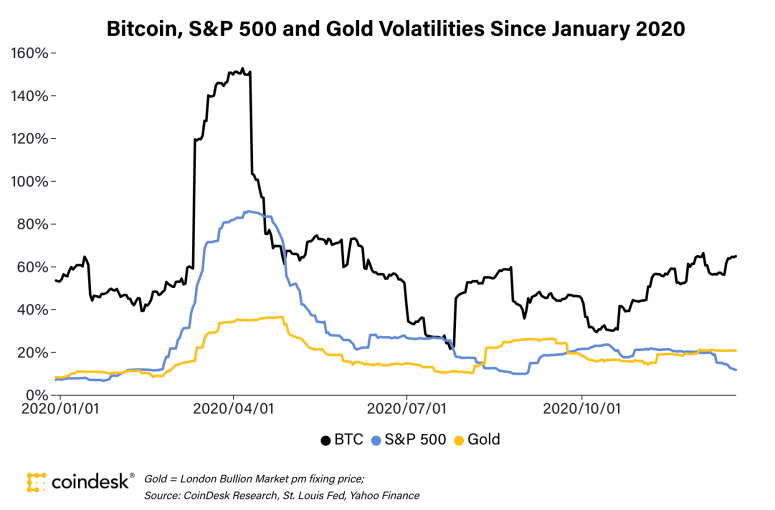

“The bitcoin market is highly levered at the time and volatility spiked sharply with the $20,000 break,” said macro cryptocurrency analyst Alex Kruger. A “$1,000 move (~5%) under current circumstances is rather ordinary. Expect such price action to continue until leverage and [trading] volumes come down.”

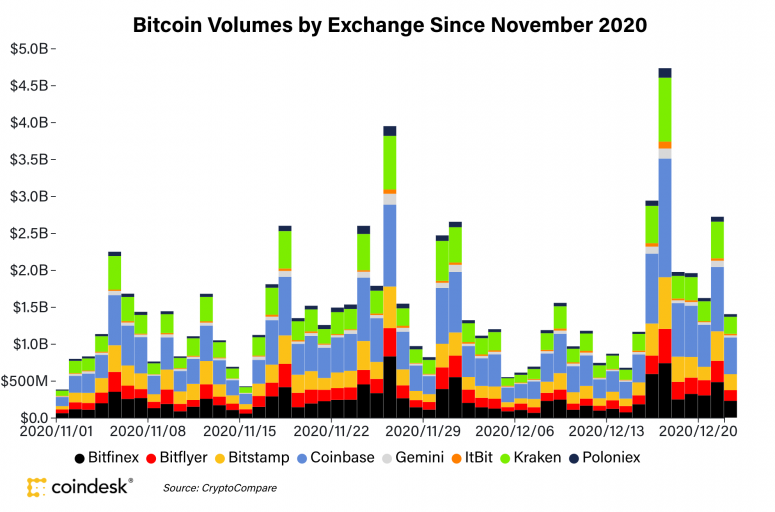

With most people already headed out for the holidays, bitcoin’s trading volumes on the eight major exchanges tracked in the CoinDesk 20 have not come down since November.

It is possible Monday’s small drop in pricing was viewed as another great opportunity for many new and big players in the crypto space, traders and analysts told CoinDesk, and that partly drove the quick recovery on bitcoin’s price on Tuesday. It is now approaching $24,000.

“Regardless of the short term, the trend is showing demand rising for bitcoin, especially by big players that want to get into the crypto market,” said Alessandro Andreotti, an over-the-counter crypto trader, who also said $24,000 will be the next resistance level.

“If it was my guess, the dump was related to macro fears related to the coronavirus,” Ryan Watkins, research analyst at Messari, told CoinDesk. “I think it’s pretty clear the bullish trend is intact and I expect dips to be bought from here on out.”

Another potential reason for recent volatility is the differing attitudes towards bitcoin by investors in different parts of the world.

“European and American institutions are bullish, Asian retail investors are bearish,” Simons Chen, executive director of investment and trading at Hong Kong-based crypto lender Babel Finance, told CoinDesk. “Therefore, prices have remained volatile recently. But as traditional institutions continue to enter the market, a new price rally is only a matter of time.”

Notably, bitcoin’s price traded lower during Asia trading hours, but has been trending up since the markets opened in the U.S. Tuesday.

Bitcoin’s volatility has remained much higher than the volatility of the S&P 500 stock index and of gold, and has gone up since October, according to data compiled by CoinDesk.

Ether follow’s bitcoin’s positive trend

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Tuesday, trading around $626.26 and climbing 2.35% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

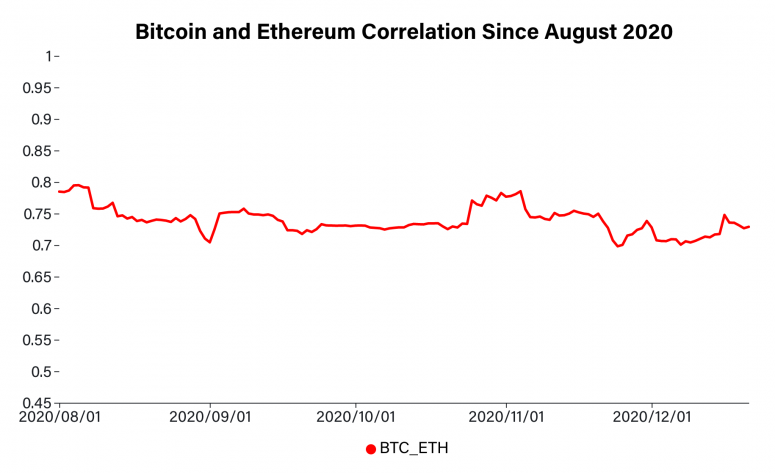

Like most of the other cryptocurrencies, ether’s price has followed bitcoin’s recovery, yet it has still largely underperformed the oldest cryptocurrency.

Ether “looks to simply be riding the coattails of bitcoin,” Vishal Shah, an options trader and founder of derivatives exchange Alpha5, said. “All said, the ether/bitcoin cross continues to grind in favor of bitcoin, and there’s limited reason to see that derail. Ether could continue to underperform.”

Other markets

Digital assets on the CoinDesk 20 are mixed Tuesday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- litecoin (LTC) + 6.01%

- cardano (ADA) + 3.09%

- algorand (ALGO) + 3.83%

Notable losers:

- xrp (XRP) – 10.91%

- orchid (OXT) – 5.44%

- 0x (ZRX) – 2.31%

Equities:

- Asia’s Nikkei 225 closed in the red 1.04% as a new coronavirus strain in the U.K. threatens the global economy recovery.

- The FTSE 100 in Europe closed higher by 0.57% on Tuesday, a small recovery from Monday’s sell-off on the U.K.’s new coronavirus concerns.

- The S&P 500 in the United States was down 0.21% as investors seek direction from the potential impact of the new variant of coronavirus found in the U.K.

Commodities:

- Oil was down 2.19%. Price per barrel of West Texas Intermediate crude: $46.93.

- Gold was in the red 0.89% at $1859.93 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield fell Tuesday dipping to 0.92 and in the red 0.05%.