Bitcoin hits a new high at $23,770 on higher-than normal volume; DeFi’s total value locked has also hit a record on the strength of ether.

- Bitcoin (BTC) trading around $22,818 as of 21:00 UTC (4 p.m. ET). Gaining 9% over the previous 24 hours.

- Bitcoin’s 24-hour range: $20,756-$23,770 (CoinDesk 20)

- BTC below its 10-hour moving average but well above the 50-hour on the hourly chart, a bullish-to-sideways signal for market technicians.

The price of bitcoin continued its rise to all-time highs, going up to $23,770 as of press time in a highly bullish run that had lots of volume-fueled momentum.

The $23,800 level may be a spot of exhaustion for the world’s oldest cryptocurrency, according to Constantin Kogan, partner at financial firm Wave Financial. “There’s some strong selling resistance at $23,800. Let’s see if bitcoin can break it,” Kogan told CoinDesk.

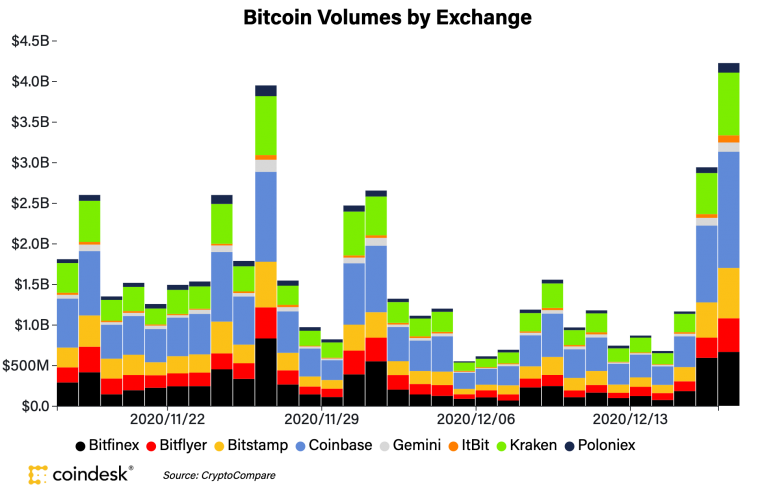

Volumes on Thursday were higher than on Wednesday, with the eight major exchanges tracked by the CoinDesk 20 seeing over $3.5 billion in volume so far as of press time versus $2.9 billion the day previous.

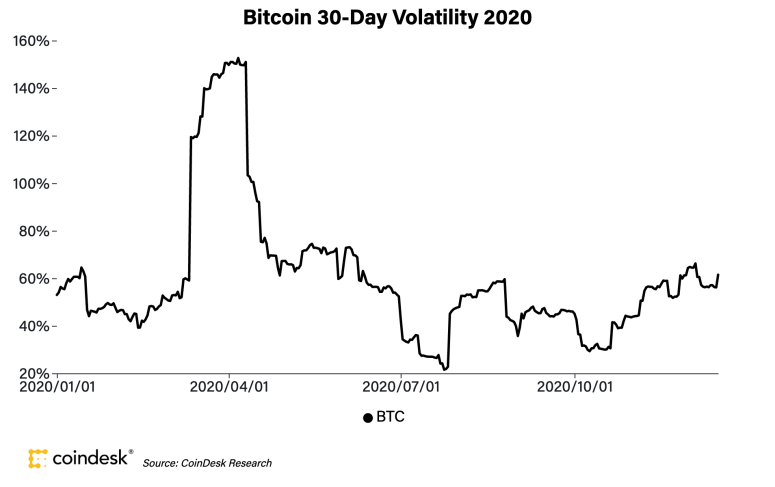

“Breaking the $20,000 psychological barrier was a strong bullish signal allowing bitcoin to set a new record high,” said Elie Le Rest, partner at crypto quant trading firm ExoAlpha. However, Le Rest cautioned about crypto’s classic gyrations possibly affecting the market. “Volatility is very high and small pullbacks have been witnessed along the way.”

Indeed, bitcoin’s 30-day volatility has been picking up and will be something to watch over the balance of December.

“Traders should be careful and on the lookout for stronger pullbacks, especially with year-end approaching and traders looking to close their 2020 profit-and-loss,” added LeRest.

Chris Thomas, head of digital assets Swissquote Bank concurred, saying the most recent move feels too strong for his taste. “I’m just waiting for a few big sellers to come back to the market and take profits,” Thomas said. “Let’s look ahead to the next few weeks. Institutional volumes will drop significantly through Christmas so the market will be driven by retail until early January.”

“This should cause us to keep the high volatility, but we’ve got to also be aware there may be a chance of testing $20,000 to the downside,” added Thomas.

Henrik Kugelberg, a crypto over-the-counter trader, noted “fear of missing out” or FOMO as a factor playing into the market’s fervor. “There is of course an element of FOMO in this but the fundamentals are stable as pyramids,” Kugelberg said. “I have said $30,000 before summer but by the looks of this, that might be a very low bid.”

Ethereum network locked value at all-time high

The second-largest cryptocurrency by market capitalization, ether (ETH) was up Thursday trading around $640 and climbing 2.7% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

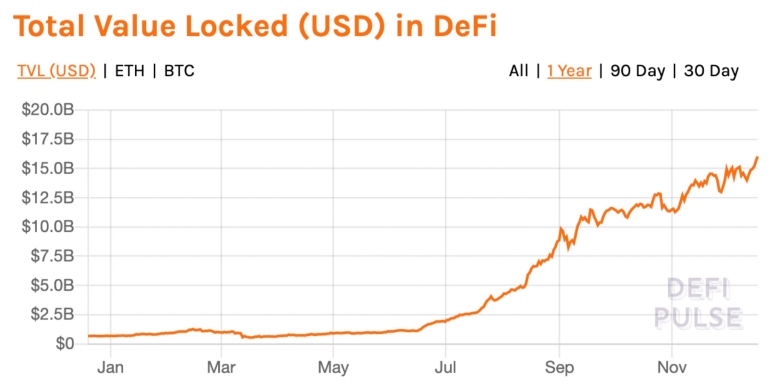

The amount of crypto “locked” in decentralized finance, or DeFi, is at $16 billion as of press time, increasing over 2,200% from the $690 million locked at the start of 2020.

Meanwhile, the amount of ether locked in DeFi is going up, over 7.1 million ETH total.

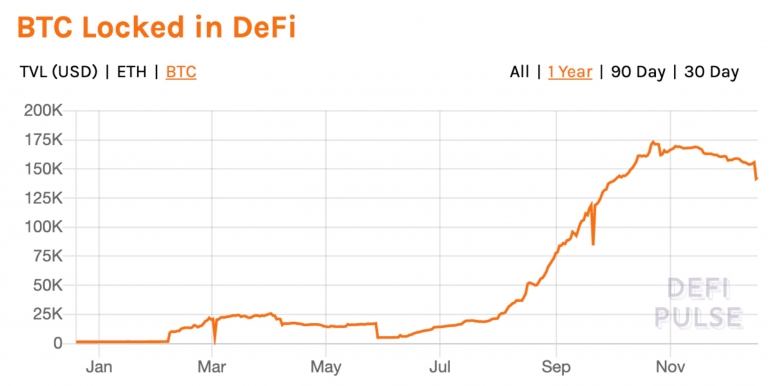

Yet the amount of bitcoin locked in DeFi has actually fallen during the market’s price run, down to 142,652 BTC.

Nicholas Pelecanos, head of trading for blockchain ecosystem provider NEM, told CoinDesk many investors continue to overlook the Ethereum network and its alternative assets, also known as altcoins.

“While bitcoin has largely dominated the narrative, I believe investors should look to altcoins that have tremendous amounts of development in both the core technology and usership, yet are still a fair way off their all-time highs,” said Pelecanos. “I am expecting to see the price of these altcoins, such as ETH and XEM, rally hard when the BTC price inevitably slows down.”

Other markets

Digital assets on the CoinDesk 20 are mostly green Thursday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- xrp (XRP) + 14%

- litecoin (LTC) + 13%

- stellar (XLM) + 5.5%

In addition, prices for COMP, the governance token for the Ethereum-based lending protocol Compound, jumped on the news that Compound Labs will build a new blockchain to provide money market services across multiple networks.

As CoinDesk reported, the new blockchain could be significant because those new supported assets won’t be limited to blockchains – it is designed to also support the forthcoming and rumored central bank digital currencies. Like Compound v1, the new blockchain will also be governed by the COMP token. Once it goes live, it will add more value to COMP holders. At the time of writing, prices for COMP were traded at $167.14, up 9.43% in the past 24 hours, according to Messari.

Notable losers:

- orchid (OXT) – 2%

- algorand (ALGO) – 1.8%

- omg network (OMG) – 1%

Equities:

- Asia’s Nikkei 225 ended the day climbing 0.18%, led higher by gains in Fujitsu Ltd., Mitsubishi Materials Corp. and Softbank Group Corp, all up 4% or more Thursday.

- The FTSE 100 in Europe closed down 0.30% after the Bank of England announced it would keep interest rates at 0.10%.

- The S&P 500 in the United States gained 0.60% as optimism towards more government stimulus before the end of 2020 boosted the index.

Commodities:

- Oil was up 1.1%. Price per barrel of West Texas Intermediate crude: $48.40.

- Gold was in the green 1.1% and at $1,884 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield climbed Thursday jumping to 0.933 and in the green 1.2%.