Apart from a brief $18,100 test on Dec. 1, Bitcoin (BTC) markets remained relatively calm over the week. This suggests that investors are beginning to realize that a more extended period of consolidation could be possible after a 77% hike since October.

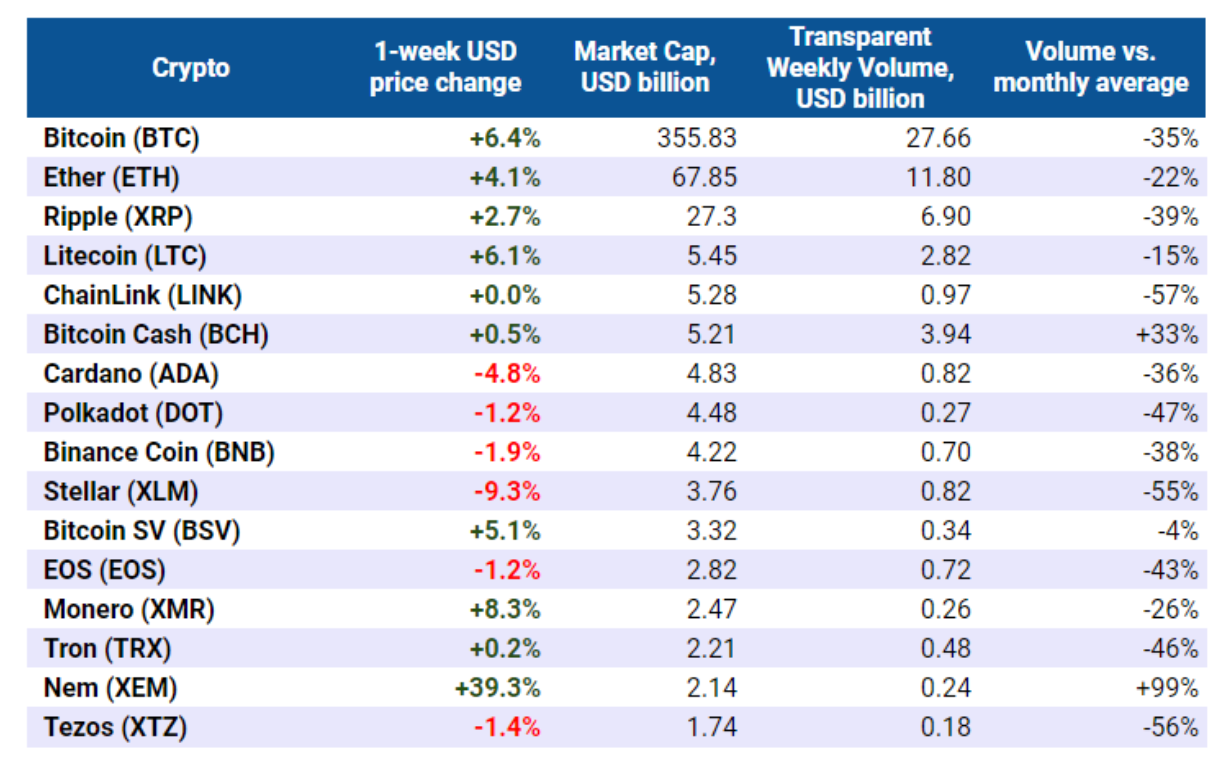

Whenever the Bitcoin price stabilizes, there is always an increased expectation of an altcoin rally. That hasn’t been the case recently, as BTC dominance increased by 0.8% to 63.6% this week.

This move signals that investors are either waiting for a $20,000 resistance break or fearing a potential negative price swing. Thus, such a movement indicates that their confidence in altcoins has diminished.

The above chart shows how Bitcoin has managed to gain market share this week. Apart from Nem (XEM), the remaining altcoins moved up 0.5%. Volumes have been disappointing overall, although this can partially be explained by BTC accumulation at the $19,200 level.

Whenever traders are undecided, they reduce positions and wait for better entry points. Therefore, this week’s volume drop has been an adjustment rather than a lack of interest.

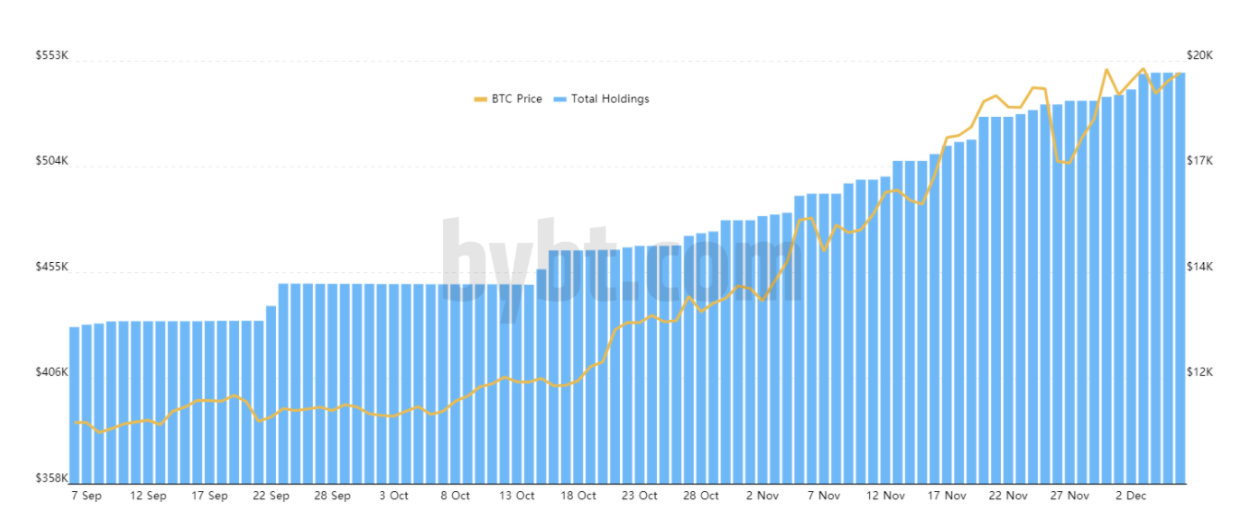

Institutional investors accumulate while Bitcoin price consolidates

Crypto fund manager Grayscale Investments continued to aggressively add BTC to their portfolio, surpassing the $10 billion mark.

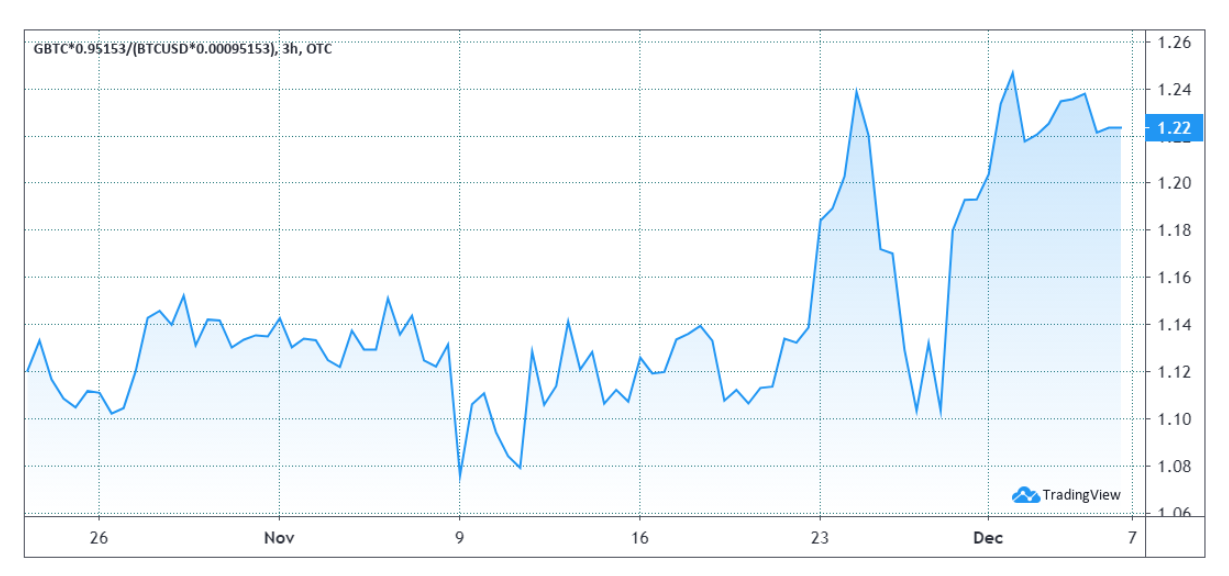

Over the past week, almost 13,000 BTC have been added, totaling 547,000. Therefore, it was another great week for Grayscale Bitcoin Trust. Similar excitement can be seen by analyzing its premium over the effective BTC held by each share, currently at 0.00095153 BTC.

As depicted above, the premium increased to 22% from 11% the previous week. The indicator maintained a 14% premium average over the past ninety days. Therefore it reflects positive momentum as it recently marked a 6-month high.

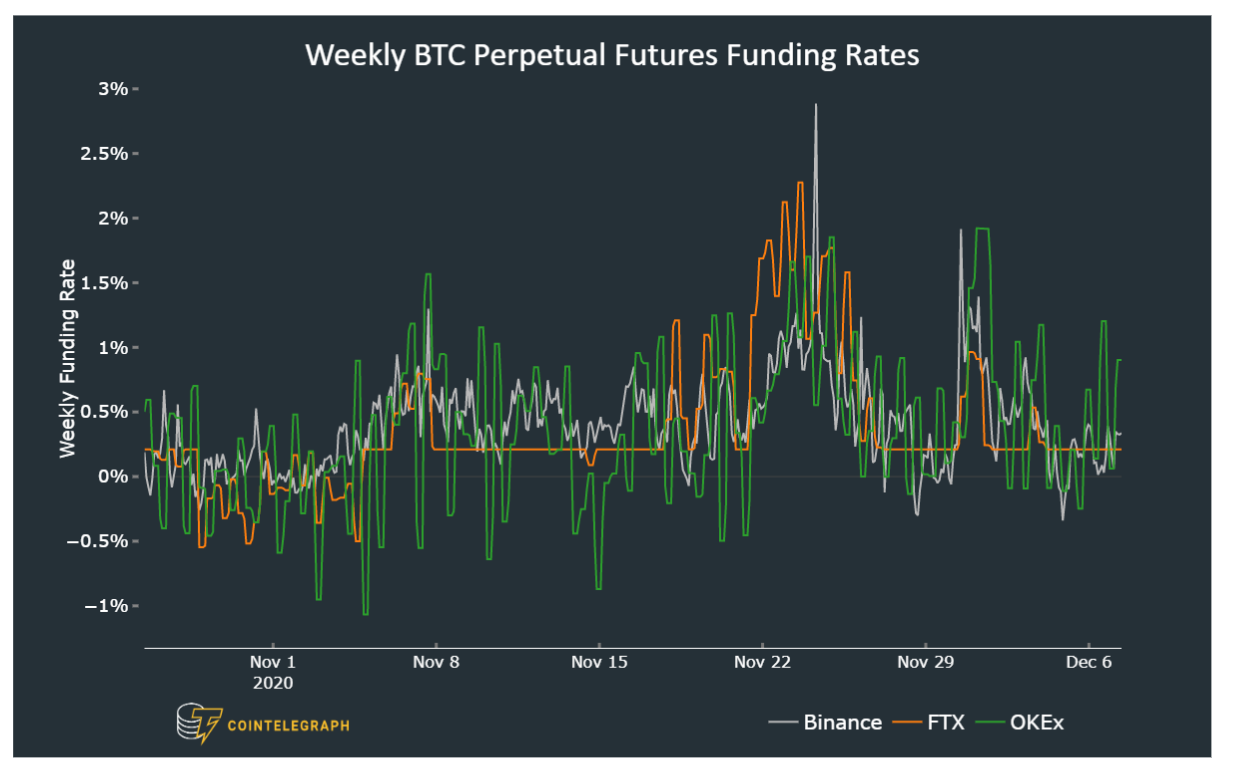

Perpetual futures funding held steady

Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Funding rates ensure there are no exchange risk imbalances. Even though both buyers and sellers’ open interest is matched at all times, the leverage can vary.

When buyers (longs) are the ones demanding more leverage, the funding rate turns positive. Therefore, the buyers will be the ones paying up the fees. This issue holds especially true during bull runs, when there is usually more demand for longs.

Sustainable rates above 2% per week translate to extreme optimism. This level is acceptable during market rallies but problematic if the BTC price is sideways or in a downtrend.

In situations like these, high leverage from buyers increases the potential for large liquidations during surprise price drops.

Take notice how, despite Bitcon’s stagnate price, the weekly funding rate managed to sustain a healthy level. This data indicates that traders remain optimistic, although they are far from being overleveraged.

A brief moment of excitement was also seen in the early hours of Dec. 1 when BTC tested the $19,900 level.

Futures premium peaked but has since normalized

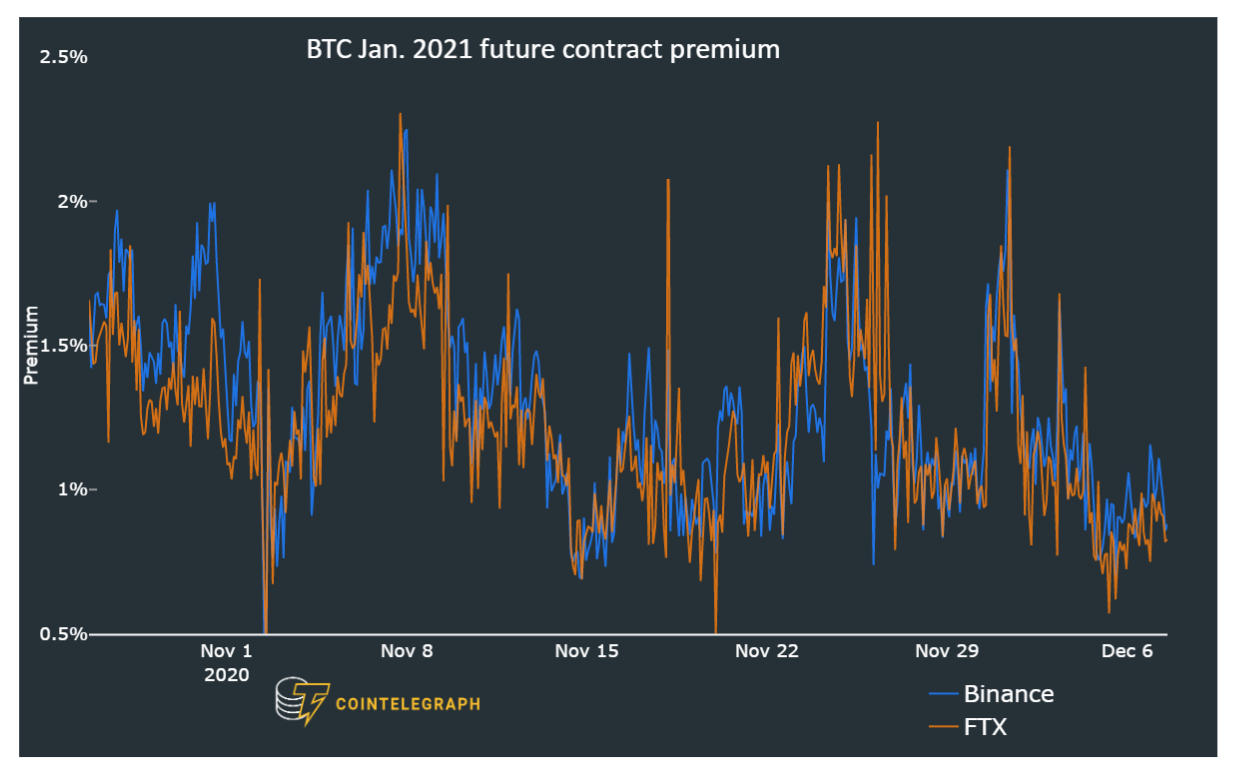

The funding rate might bring some distortions as it’s the preferred instrument of retail traders and, as a result, is impacted by excessive leverage. On the other hand, professional traders tend to dominate longer-term futures contracts with set expiry dates.

By measuring how much more expensive futures are versus the regular spot market, a trader can gauge their bullishness level. The fixed-calendar futures should usually trade with a 0.5% or higher premium versus regular spot exchanges.

Whenever this indicator fades or turns negative, this is an alarming red flag. Such a situation, also known as backwardation, indicates that the market is turning bearish.

The above chart shows that the indicator briefly touched 2% on Dec. 1 but later adjusted to 0.9% as Bitcoin failed to break the $20,000 resistance. Regardless of the drop, it has held above the minimum 0.5% threshold, indicating optimism from professional traders.

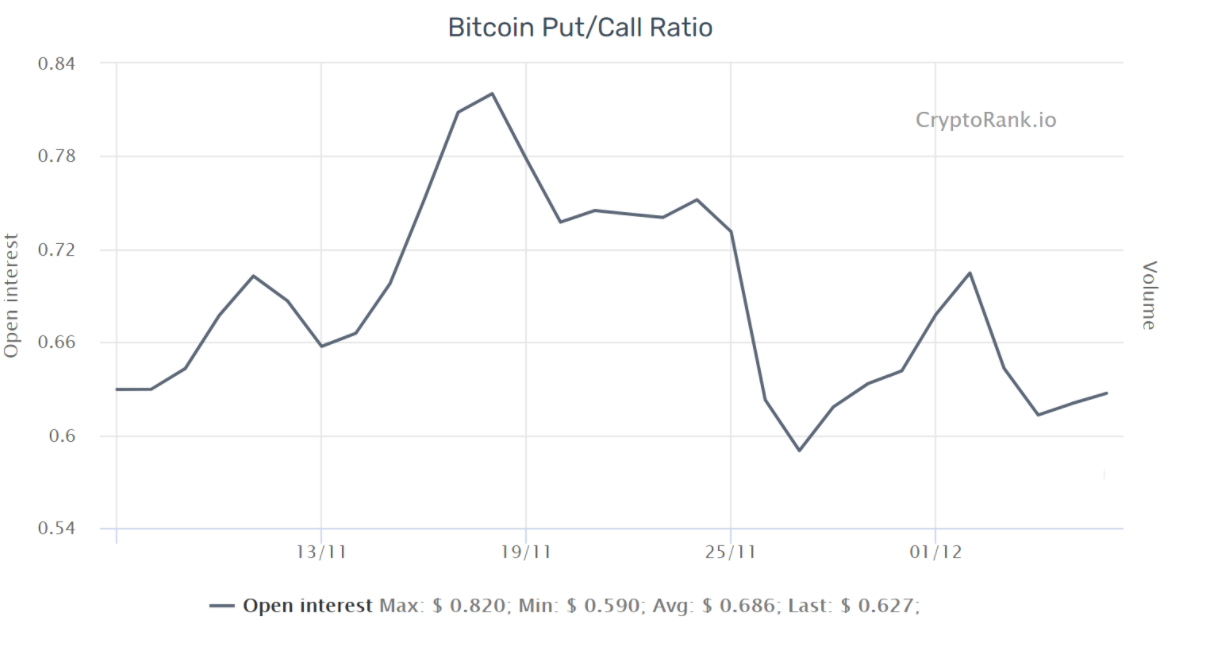

Options put/call ratio

By measuring whether more activity is going through call (buy) options or put (sell) options, one can gauge the overall market sentiment. Generally speaking, call options are used for bullish strategies, whereas put options for bearish ones.

A 0.70 put-to-call ratio indicates that put options open interest lag the more bullish calls by 30% and is therefore bullish.

In contrast, a 1.20 indicator favors put options by 20%, which can be deemed bearish. One thing to note is that the metric aggregates the entire BTC options market, including all calendar months.

As Bitcoin price approaches $20,000, it’s only natural for investors to seek downside protection. As a result, the put-to-call ratio peaked at 0.70 on Dec. 2. Albeit the increase, it was still favoring the more bullish call options by 30%.

After this excitement period, the indicator has moved back to a healthy 0.63. Considering that 0.67 has been the average for the past 3 months, it should be deemed bullish as fewer investors are buying protective put options.

Bitcoin price is flat, but investors remain bullish

Overall, each of the key indicators discussed above have held steady within their expected range, especially considering the market recently pulled back to $18,100.

As BTC holds above $19,000, investors may begin to second-guess the odds of creating a new all-time high, and some will probably rush to take profits.

At the moment, there has not been an indicator that is ringing the alarm bell. The overall bullishness remains, although the absence of an altcoin rally during BTC’s period of consolidation may damper investors’ mood.

The views and opinions expressed here are solely those of the author