Investors in the Bitcoin options market could be turning slightly bearish in the near term, order books show.In the options market, the value of call options rises when the price of an asset appreciates. In contrast, the value of put options increases when the price of an asset falls.Essentially, a call option is a buy order and a put option is a sell order in the options market.On December 7, Laevitas, a data analytics firm that uses quantitative finance models, reported that puts action in the Bitcoin options market has been increasing.

Lots of #BTC puts action this morning on @DeribitExchange and @tradeparadigm pic.twitter.com/JthuQj52mW

— Laevitas (@laevitas1) December 7, 2020

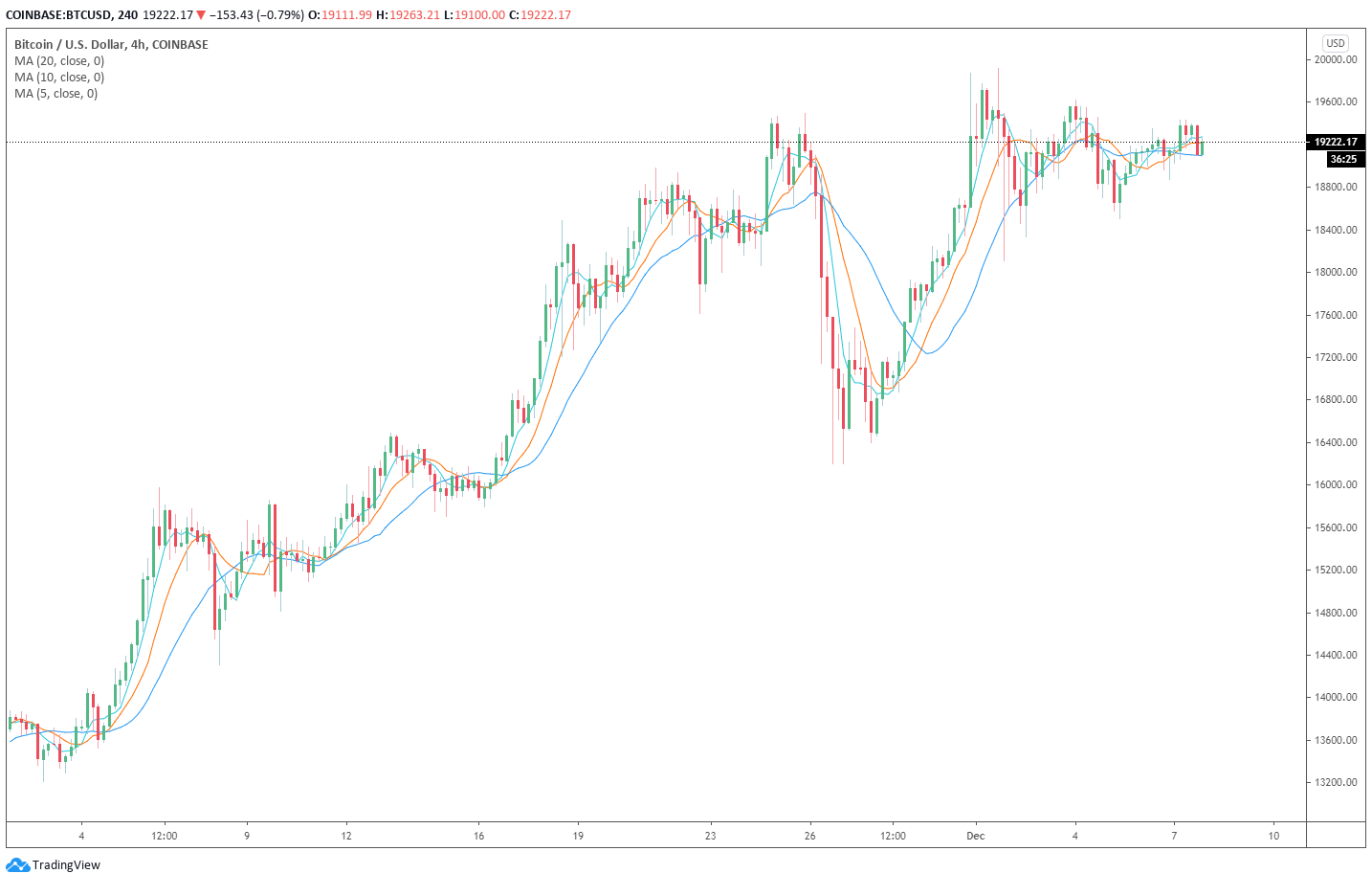

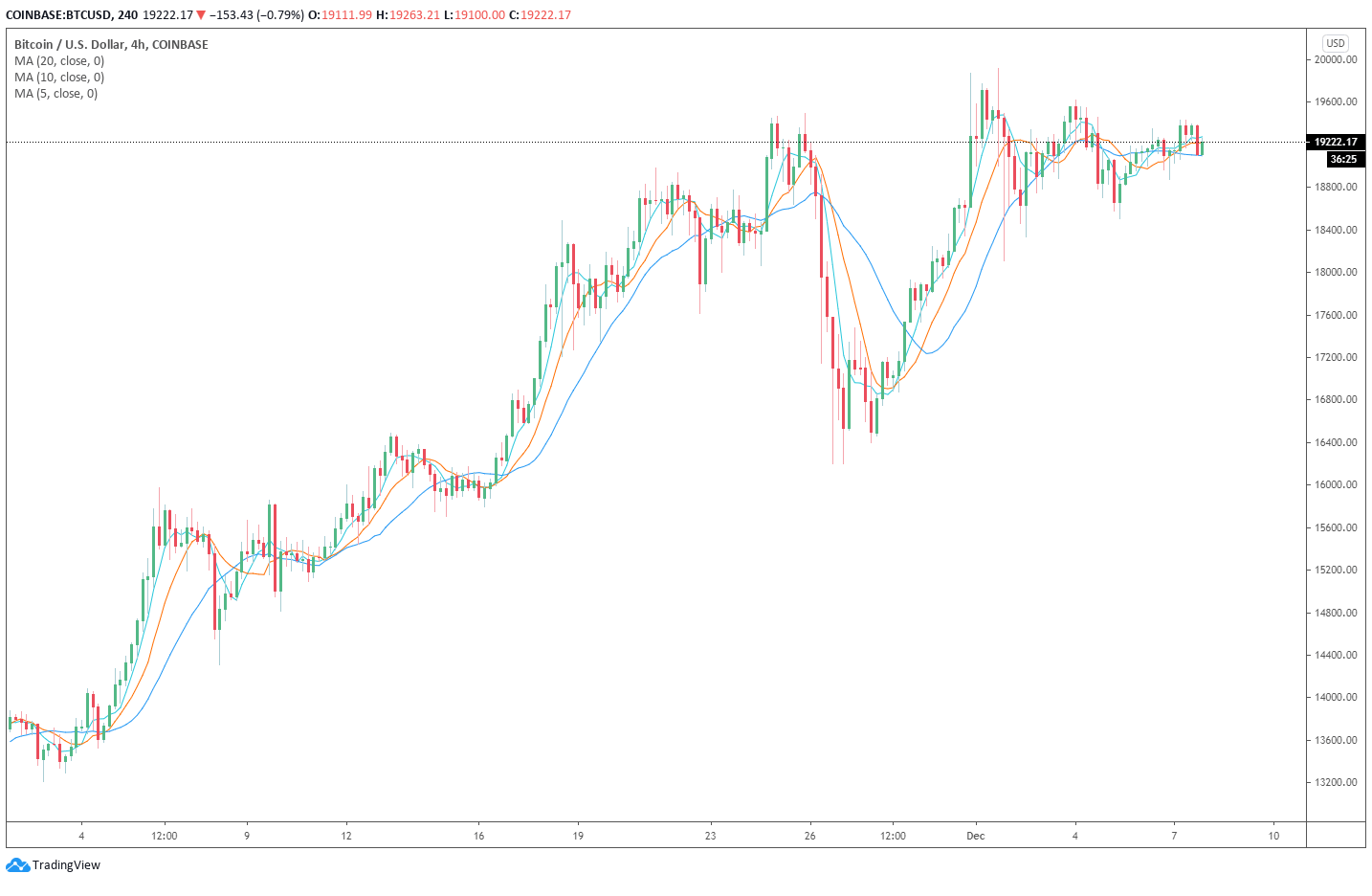

Why is the options market bearish on Bitcoin?There are two potential reasons why investors in the options market are leaning bearish on Bitcoin.First, Bitcoin has been unable to break past the $20,000 resistance level. Exchange order books show that the all-time high is stacked with significant sell orders. As CryptoSlate reported, on-chain analysts explain that this trend could lead to a prolonged consolidation phase or a correction.Second, data show that the CME BTC futures market has seen an uptick in short-selling in recent weeks. Some say that these shorts are likely hedge shorts or investors providing liquidity to institutions. Still, they apply selling pressure on the Bitcoin market nonetheless.Technical analysts also note that Bitcoin is in a “boring” phase where certain price levels would trigger volatility.Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said that Bitcoin either breaks past $19,400 to see a rally or drops below $18,600 to record a correction. He wrote:

“Still stuck in a range here, through which the volatility will kick in above $19,400 and below $18,600. Until then, range-bound.”

The uncertainty in the direction of Bitcoin in the near term is primarily driving the rising level of short-selling in the market.