Bitcoin was lower, staying in the past week’s range of roughly $18,500 to $19,700. Prices are up 167% year to date, having started off 2020 at around $7,160.

“There is no doubt that $20,000 remains a barrier, both from a technical perspective and on an ideological level,” Simon Peters, an analyst for the trading platform eToro, wrote Monday in an email.

In traditional markets, European shares fell, led by banks and retailers. U.S. stock futures pointed to a lower open as investors worried a coronavirus resurgence might weigh on the economic recovery. The British pound slid 1.5% against the dollar on concern Brexit talks might collapse. Gold weakened 0.4% to $1,831 an ounce.

Market moves

It’s the question everyone’s asking: With bitcoin prices nearly tripling this year and reaching a new all-time high of $19,920, is it too late for investors to jump in, or is the rally just beginning?

“Attention is starting to shift towards analyzing where we are in the market cycle,” the cryptocurrency research firm Coin Metrics wrote last week in a report.

None other than Mohamed El-Erian, chief economic adviser for the German financial firm Allianz, which has €2.3 trillion (US$2.8 billion) of assets under management, tweeted last week that he had sold bitcoin after buying some two years ago at $4,728. The original purchase was made “not on a deep analysis but rather on the basis of technicals” as well as to get “a feel for what’s becoming a more popular holding,” according to the tweet. The decision to sell was “again not based on any deep analysis,” he wrote. Based on a rough analysis by First Mover, El-Erian quadrupled his money on the round trip.

But one traditional finance guy using admittedly cursory analysis does not a market make. A lot of cryptocurrency analysts and investors are convinced that now’s not the time to take profits on bitcoin, even after its market capitalization surged this year to more than $350 billion.

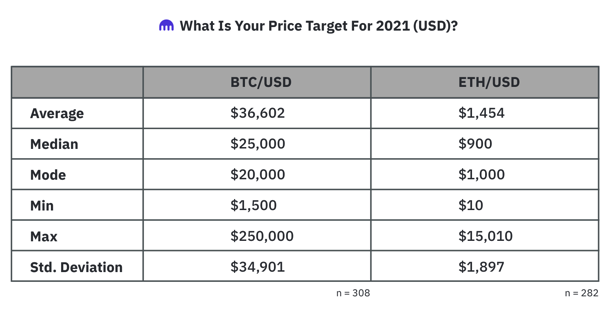

Last week, Kraken Intelligence, a research unit of the digital-asset exchange Kraken, published results of a survey noting that clients expect an average bitcoin price of $36,602 in 2021, nearly double the current level.

As discussed previously in First Mover, one of the problems with valuing bitcoin is that the cryptocurrency was just invented 11 years ago, so there’s no deep history of reliable analytical factors to key off, such as the stock market’s price-to-earnings ratios, bond-market yield comparisons or even the supply-and-demand forecasts used in commodities.

So it’s impossible to say whether the latest price levels represent nosebleed levels or are more akin to an oxygen-rich hyberbaric chamber.

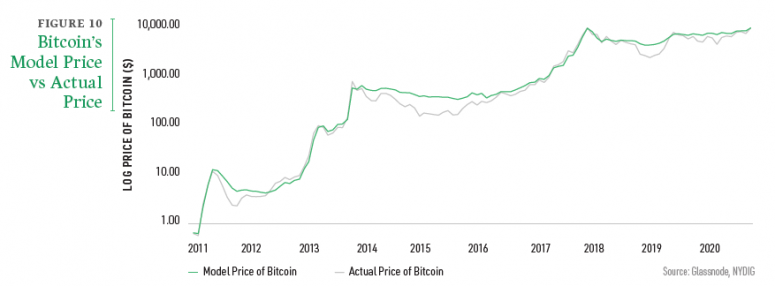

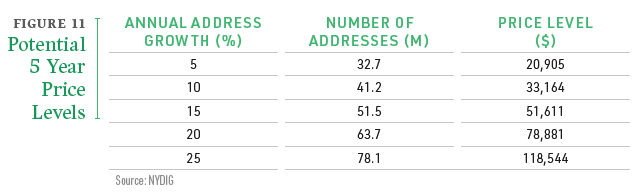

Greg Cipolaro, global head of research for NYDIG, an investment firm that recently raised $150 million for two new cryptocurrency funds, has co-authored a report with Ross Stevens, the firm’s co-founder and executive chairman, arguing that growth in the Bitcoin network could justify a price range of $51,611 to $118,544 in five years.

The forecast relies on Metcalfe’s Law, which according to Wikipedia, is attributed to Robert Metcalfe, an Internet pioneer who now serves as a University of Texas professor of innovation and entrepreneurship.

As summarized by the NYDIG report, Metcalfe’s Law “states that a network’s value is proportional to the square of the number of its users.”

“Given our view that, as an emergent successful money, bitcoin’s fundamental value derives from its network effects, bitcoin’s value should roughly adhere to Metcalfe’s Law,” the authors wrote. “This may be an important insight for investment professionals who, understandably, require anchoring around a fundamental valuation framework as a necessary component of their allocation diligence and analysis.”

So far, according to the report, the valuation metric appears uncannily accurate:

Of course, nobody knows the future, now matter how confident they sound.

And NYDIG’s price projection does require assumptions about how fast bitcoin’s network grows during the first half of the 2020s. Over the past 12 months, the number of Bitcoin addresses has grown by 18%. So the authors assume growth rates of 5% to 25% over the coming years.

“The reality is that there are many potential future growth rates, and we truly have no idea where growth rates will land,” according to Cipolaro and Stevens. They added a “reminder that all models are wrong. Some are useful.”

With many investors now simply asking whether bitcoin’s failure last week to surpass $20,000 might be due to psychological factors, it can’t hurt to be aware of an analytical method that so far has worked pretty well.

– Bradley Keoun

Bitcoin watch

Bitcoin’s price set a new all-time high at $19,920.53 last week. Since then, however, the oldest cryptocurrency has struggled to break above the $20,000 level.

The bull momentum has stalled with large sell orders capping the upside near $20,000, according to some analysts.

“People are trying to sell at this level based on what happened during the 2017 bull market,” Simon Chen, executive director of investment and trading at Hong Kong-based crypto lender Babel Finance told CoinDesk. Bitcoin peaked near $20,000 three years ago and fell as low as $6,000 by early February 2016. The bear market ended near $3,200 in December 2018.

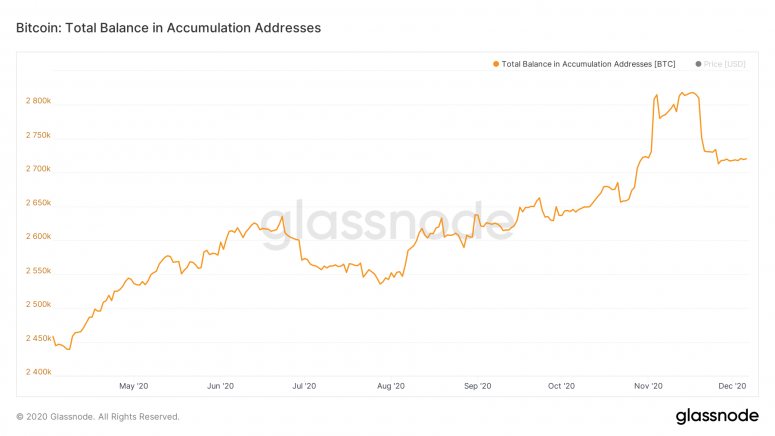

Data extracted from the Bitcoin blockchain network backs Chen’s analysis. The number of accumulation addresses – a proxy for those who are buying and holding – has dropped to 495,000 from 514,000 over past four weeks, according to data source Glassnode. The decline suggests that some longer-term investors might be taking profits at these price levels.

Accumulation addresses are those that have at least two incoming “non-dust” transfers (representing minuscule amounts of bitcoin) and have never spent funds. The metric does not include addresses belonging to miners and exchanges and excludes addresses active more than seven years ago to adjust for lost coins.

The total balance held in these accumulation addresses has dropped to 2.72 million BTC, from more than 2.8 million BTC, in the past two weeks.

According to some analysts, the cryptocurrency needs to make a quick move above $20,000 to avoid a drawdown. “I think the longer bitcoin continues to reject $19,500 and $20,000 with whale-induced sell-offs, the probability of some more consolidation/correction increases in the near term,” market analyst Joseph Young tweeted.

– Omkar Godbole

Token Watch

XRP (XRP): Coinbase to support Spark token airdrop to XRP holders (CoinDesk)

Ether (ETH): Grayscale’s Sonnenshein sees “growing conviction around Ethereum as an asset class.” (Editor’s note: Grayscale is a unit of Digital Currency Group, the owner of CoinDesk.)

Cardano (ADA): Blockchain project set for hard-fork upgrade to introduce token-locking mechanism, in preparation for “Goguen” development phase integrating smart contracts.

Solana (SOL): Proof-of-stake network’s block production halted due to bug, though later restarted successfully.

What’s hot

Binance expects to earn $800M to $1B this year, CEO Changpeng “CZ” Zhao tells Bloomberg (CoinDesk)

Standard Chartered, Philippines Bank issue $187M blockchain bond (CoinDesk)

U.S. House Financial Services Committee Chair Maxine Waters wants President-elect Joe Biden to rescind or monitor all cryptocurrency-related guidance issued by Office of the Comptroller of the Currency (CoinDesk)

India-based investors may soon have to pay taxes on returns earned from bitcoin investments (CoinDesk)

Apple co-founder Steve Wozniak’s new venture lists token WOZX to facilitate investments in energy efficiency projects via cryptocurrency and blockchain technology (CoinDesk)

Bitcoin miners saw 48% revenue increase in November, to an estimated $522M, according to Coin Metrics data (CoinDesk)

“We haven’t before had a technology with element-like properties, that emerged in a technology-rich era ripe for catalysts, at a time buffeted by so many other society-transforming trends and events,” CoinDesk Research Director Noelle Acheson writes in weekly column, arguing that another bitcoin can’t just be easily spun up (CoinDesk)

Analogs

The latest on the economy and traditional finance

Biden says $1,200 stimulus checks “may be still in play” in coronavirus relief talks (CNBC)

JPMorgan analysts warn of crowded trades including shorting the U.S. dollar versus cyclical developed-market currencies, long copper and long bitcoin (Bloomberg)

“When it resumes, the market economy will decide which firms prosper and which fail,” former Bank of England Governor Mervyn King writes in op-ed (Bloomberg Opinion)

Burger King India’s initial public offering attracted over $9B in bids, according to exchange data (Reuters)

Climate change could cost Asia $8.5T in damage from natural disasters per year, studies show (Nikkei Asia Review)

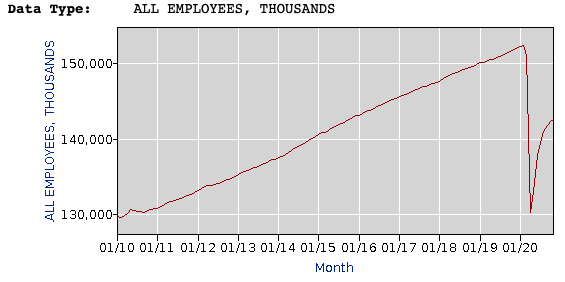

U.S. economy adds 245K jobs in November, slowest month of growth since recovery began (Washington Post):