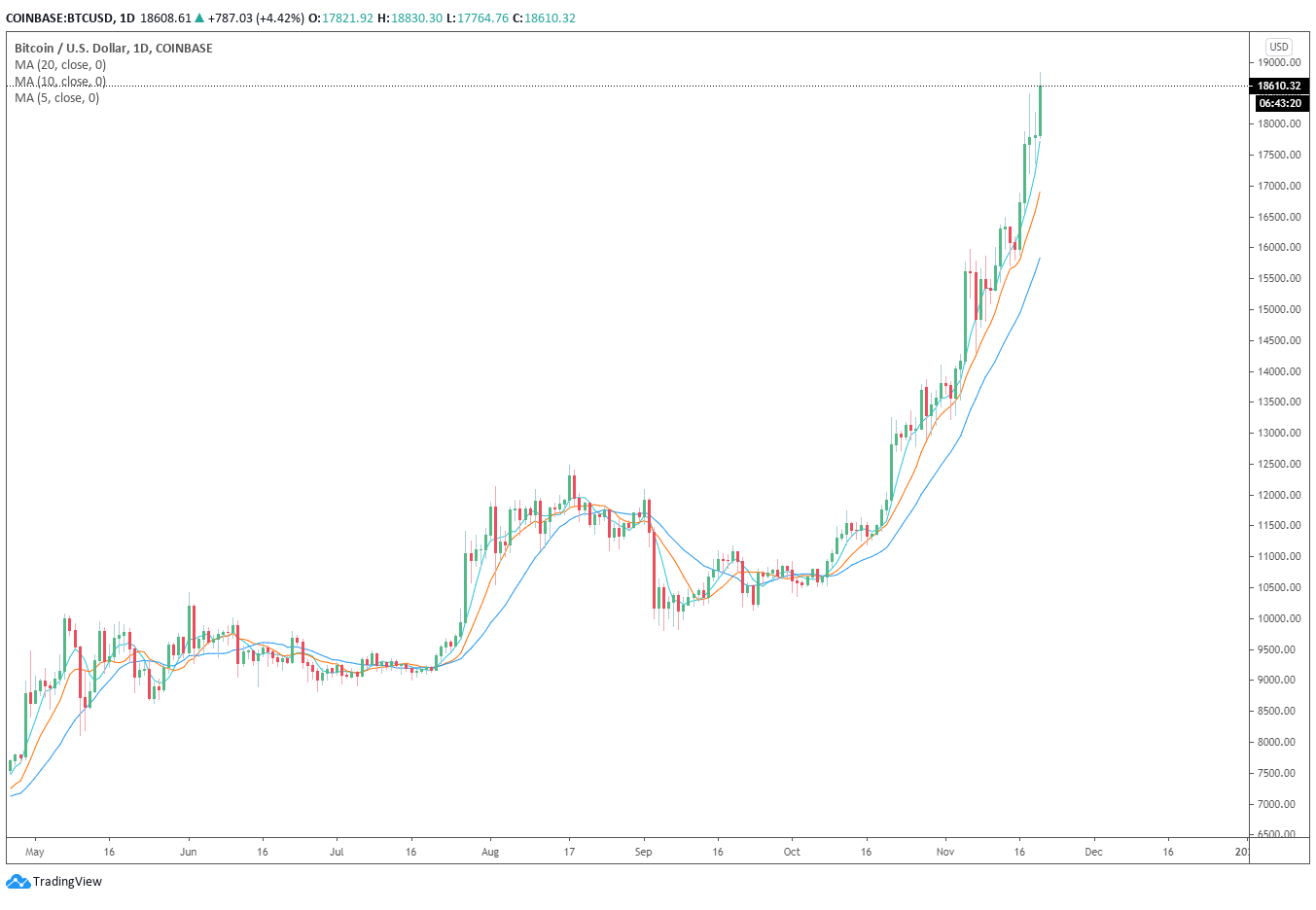

BlackRock’s CIO of fixed income Rick Rieder says Bitcoin is here to stay. On CNBC’s Market Alert, Rieder emphasized the receptivity of millennials to cryptocurrencies. Coincidentally, on Nov. 20, the price of BTC surpassed $18,800 for the first time since 2017.

Wow. BlackRock CIO of Fixed Income Rick Rieder talking about Bitcoin replacing gold on CNBC this morning. pic.twitter.com/9KZR0muJVp

— Pomp ? (@APompliano) November 20, 2020

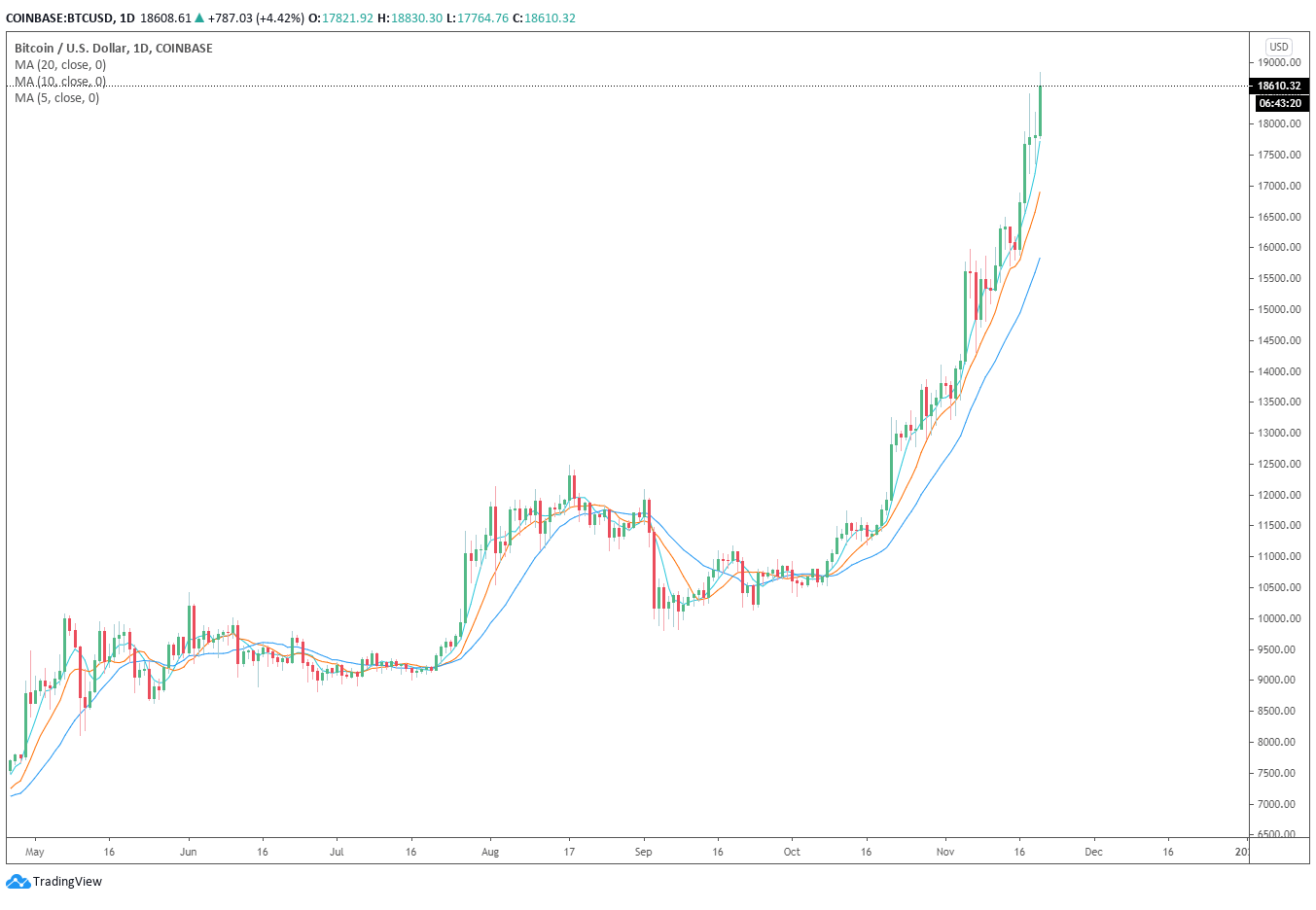

Major financial institutions and executives in the traditional financial sector are seemingly opening up towards Bitcoin.Albeit the impact institutions are directly having on Bitcoin remains unclear, the strengthening perception of BTC as a store of value is highly optimistic.Institutional investors and financial industry executives are recognizing BitcoinThe price of Bitcoin is increasing rapidly as each major dip gets accumulated with large buyer demand.Throughout the past several weeks, Bitcoin has seen significant selling pressure from whales, high-net-worth investors, and buyers.On-chain data continuously showed rising whale inflows to exchanges, signifying high sell-side pressure from major BTC holders.Yet, every major drop that tagged short-term moving averages on the 4-hour and daily Bitcoin charts were bought up quickly. This showed that there is high buyer demand in the market.

“I think cryptocurrency is here to stay. I think it is durable. I think the millennials’ receptivity of technology and cryptocurrency is real. Digital payments is real. So I think Bitcoin is here to stay.”

Rider’s comments come after JPMorgan and other investment banks drew comparisons between Bitcoin and gold.What’s next for BTC?It is difficult to price Bitcoin or arrive at a fair valuation for BTC. But, considering that more institutions are comparing BTC to gold, it would make sense to value BTC as a fraction of gold’s market capitalization.Sam Bankman-Fried, the CEO at FTX and the head of Alameda Research, said:

“Honestly this has always seemed like one of the most bullish facts to me who the fuck knows what the ‘correct’ price of BTC is but, like, does it have more or less than 1% as much importance as gold?”

Currently, the market cap of gold is estimated to be around $10 trillion. The market cap of Bitcoin is less than 4% of gold, in spite of the recent rally. A strong argument can be made that, at least in the long term, BTC is still undervalued as a store of value and a safe-haven asset.