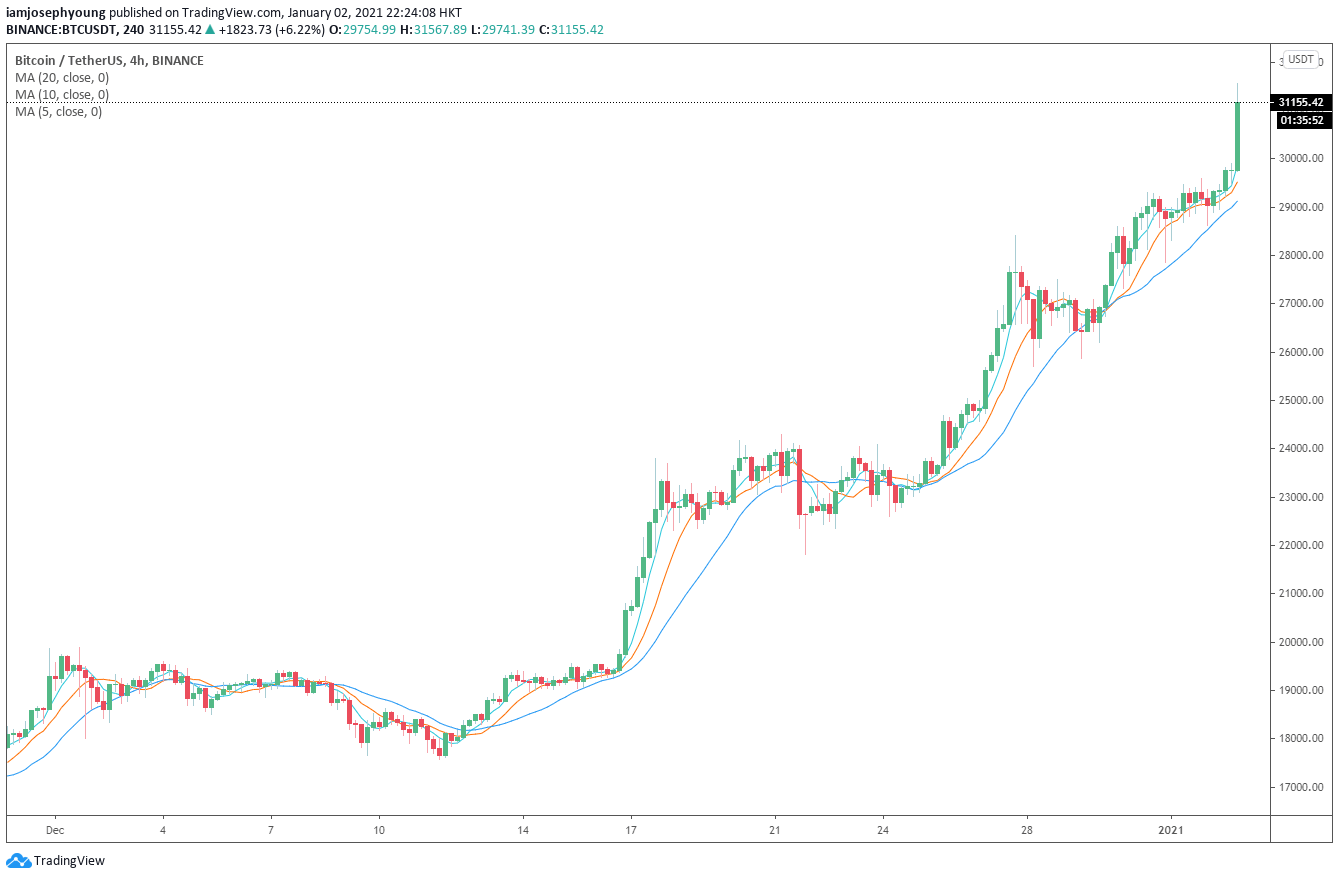

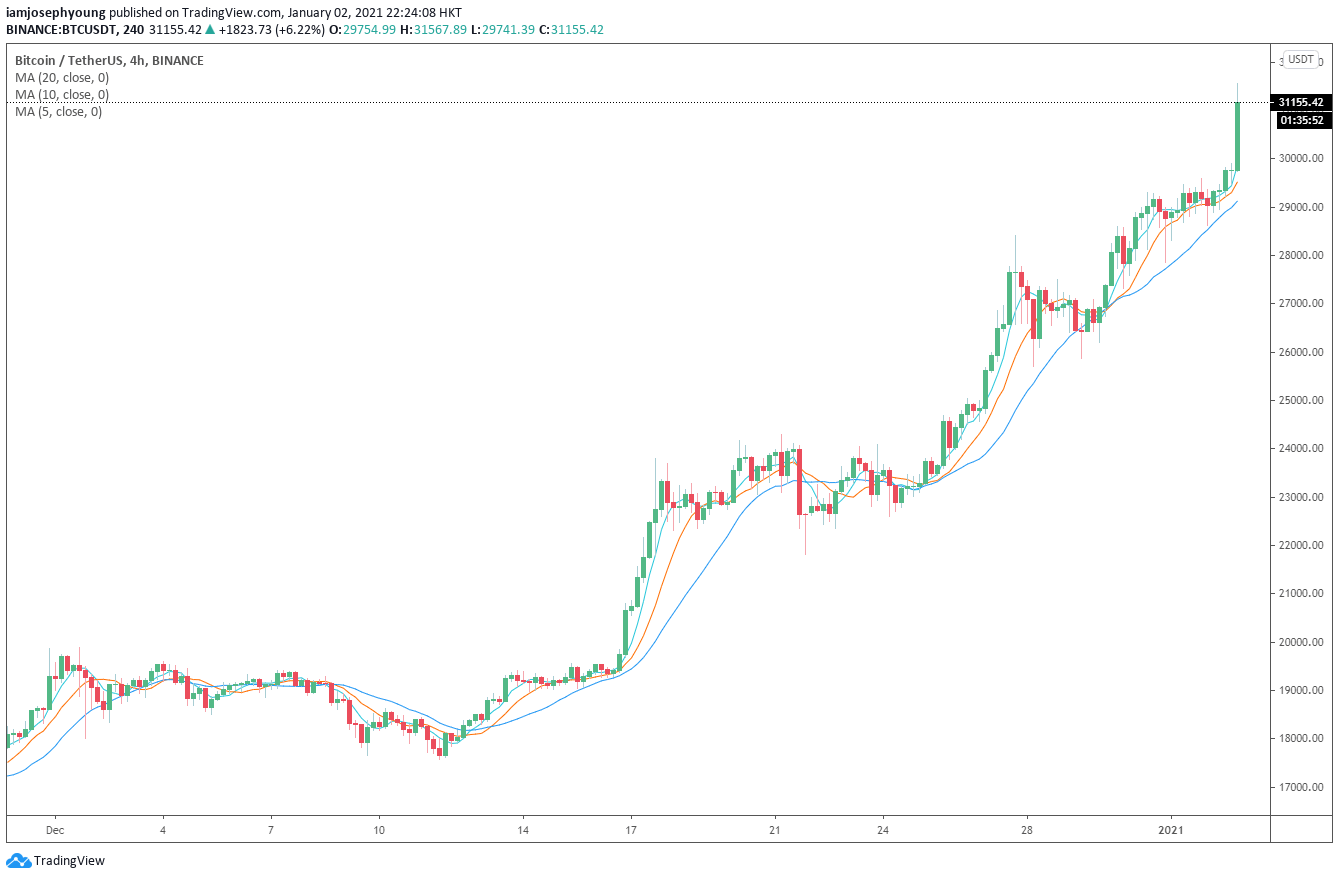

The price of Bitcoin has surpassed $32,300 on Coinbase, reaching a new all-time high after blasting past $32,000.Following BTC’s surprisingly strong rally, analysts believe the momentum of Bitcoin is sufficient to see another leg up.

“Potential scenario if price plays out like the previous cycle, Broke straight through the 1.618 extension into 2.618 at $3k before finding resistance, which would be $47k now (confluence with $1trn market cap). 39% drop from there would take us back to $29k before moon.”

“$30,000 reached, while many people are still arguing that #Bitcoin is overvalued. It’s not and this year will show the actual strength of $BTC. Good part; $ETH is also showing indications of strength as it reached a new high. Great year for crypto.”

The $30,000 price level has always been a major psychological level for the Bitcoin price. As such, there were large sell orders filed in the $29,900 to $30,000 range.But, as the price of Bitcoin began to increase with large buy orders in the spot market, the sell wall eventually weakened.This trend coincided with the mass liquidation of short contracts, causing BTC to surge rapidly within a short time frame.What could push BTC further in 2021?A pseudonymous analyst noted that institutional investors, like Guggenheim, are not ready to invest in Bitcoin despite showing interest in it.In December, Guggenheim reserved the right to purchase a portion of the Grayscale Bitcoin Trust to gain exposure to BTC.However, the analyst said that the deal is not effective with the U.S. Securities and Exchange Commission. The analyst explained:

“As BTC nears 30k, Guggenheim is still not effective with the SEC. That means they’ve been on the sidelines this entire run. This must be very frustrating, having identified BTC as a potential investment much lower, then doing all the internal research. They’re not alone.”

There could be more institutional investors, like Guggenheim, who are still sitting on the sidelines to gain exposure to Bitcoin.If these institutions continue to enter into the Bitcoin market in the first quarter, it could serve as a new catalyst for BTC in the foreseeable future.