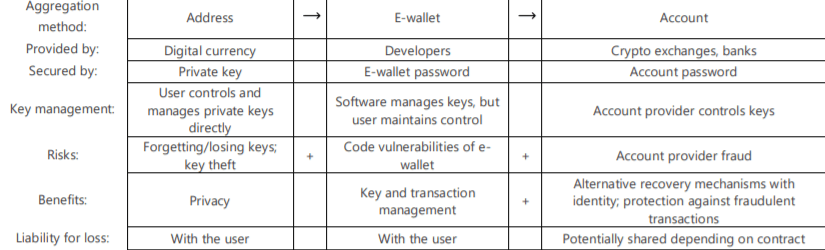

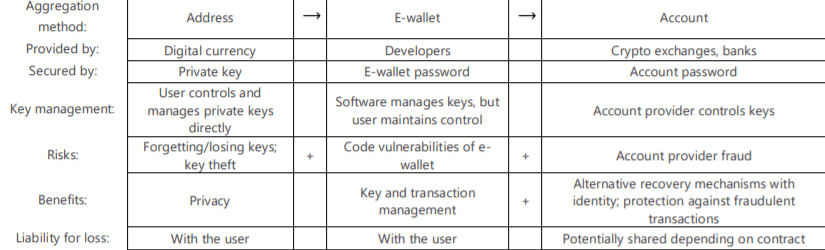

Bank of Canada analysts raised concerns over the use of Central Bank Digital Currencies (CBDCs) as countries around the world weight the use of digital tokens instead of paper-based money.Titled the “Security and convenience of a central bank digital currency,” the bank said CBDC users are likely to face three major risks from storing and using digital currency balances in anonymous addresses:

Three major risks Analysts noted these risks will be shared between users and providers. Retail participants and CBDC end-users, in particular, would enjoy the benefits of key management and third-party security feedback to ensure no theft occurs while incurring a small risk in the form of account providers (read: banks or exchanges) taking control or misusing user holdings.“Evidence shows that theft of private digital currencies and wrongdoing by account providers are quite common,” the bank said, citing a 2019 report by on-chain security provider Ciphertrace.

“Enforcement of liability rules would be further complicated if the design of the CBDC allows any individual or firm to directly hold the digital tokens.”

It added that some users may also choose to store their balances in accounts at third parties that might be out of reach of domestic authorities if they hold such tokens directly.Meanwhile, the bank analysts concluded, “Designing a CBDC that is universally accessible but that can be stored only at approved intermediaries is a technological challenge that should be investigated.”The report comes as countries like Singapore, Japan, Hong Kong, CBDCs, and China hope to introduce CBDCs in the coming years as cashless financial systems gain fruition and the use of physical money (which relies on contact) gets outlawed in the aftermath of the ongoing coronavirus pandemic.