High-throughput platforms have begun to establish themselves as hotbeds for DeFi applications, including Qtum and TRON – both of which offer similar functionality to Ethereum, albeit with drastically lower fees.

Cryptocurrencies have shaken up the way individuals think about money, and now decentralized finance is poised to change how people use that money, by providing a massive array of financial services over the blockchain.But as a rapidly emerging industry, DeFi is going through an evolution of sorts, to both overcome some of the early challenges end-users face and enable new, ever-more-powerful use-cases and features.Here, we take a look at some of the current trends we can expect to gain prominence throughout 2021 and beyond.Ethical AnonymityMuch in the way that Satoshi Nakamoto kept his anonymity when he unveiled Bitcoin (BTC) to the world, an increasing number of DeFi projects are following the same ‘ethical anonymous’ ethos, by producing DeFi solutions that empower cryptocurrency users – without establishing a central authority figure.This also acts to ensure that DeFi projects remain resistant to censorship and government manipulation, since those behind its development will be anonymous, and hence difficult to influence. This is one of the key tenets of cryptocurrencies and is often overlooked by projects with public-facing teams.If there is a single project that truly embodies this concept in 2021, it’s Prophecy – a fairly launched token and blockchain platform powered by a unique consensus engine known as Prophecy (PoCD), which is used to empower the community and power a wave of next-gen financial products.

Why on EARTH are we selling $100,000 socks?!

Find out our logic, the reward the lucky purchaser will receive, and much more in our PACKED article here: https://t.co/BjsdWjzEiF

(Almost a bigger meme than $DOGE ?)#Crypto #DeFi #Cryptocurrency

— prophecy (@Buy_Prophecy) January 29, 2021

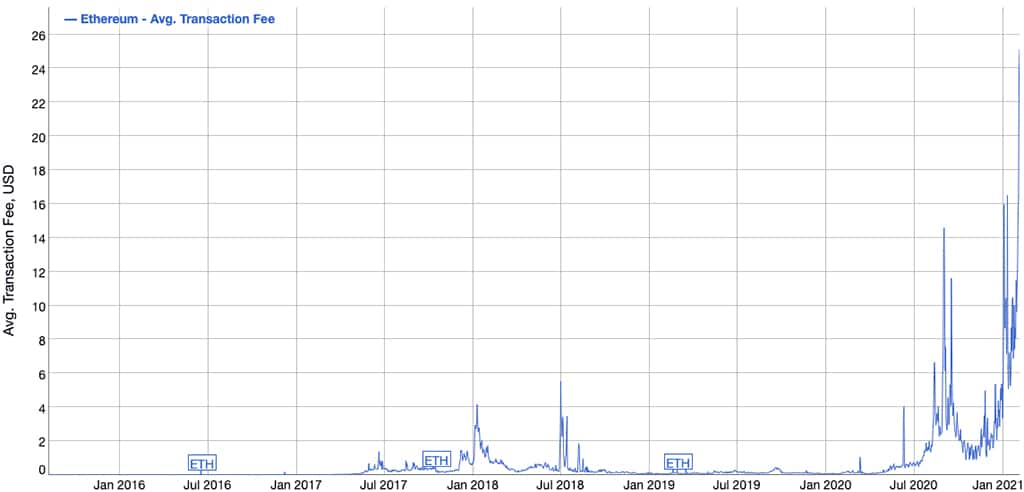

Unlike most promising projects, the team behind Prophecy is fully anonymous and holds only a small fraction of the supply. Instead, much like Bitcoin (BTC) and Monero (XMR), they’re looking to continue the trend of pushing the project from the background, helping it grow while letting its community shine.InteroperabilityRight now, the vast majority of blockchains effectively operate as a closed silo. The data and actions taken on one blockchain, generally cannot affect another. This is quite unlike traditional finance, where the bulk of financial products stack on top of one another and interconnect to some degree.This is a problem. For one, the siloed off approach leads to segregation in the blockchain community, as individual blockchain projects compete to nurture their and retain their community in the face of mounting competition. Unfortunately, this has led to the development of several ‘one size fits all’ blockchain solutions, which have attempted to build a complete ecosystem all in one place – and largely failed.It also leads to liquidity issues, since assets on one blockchain generally cannot be used on another, meaning individuals need to hold a huge range of assets to interact with a variety of DeFi applications across multiple blockchains. This is certainly not ideal.Fortunately, a number of platforms are currently being developed to help blockchains talk to one another, including Polkadot, Cosmos Network, and Wanchain – each of which promises to become the glue that helps envelop the massive cryptocurrency landscape into a single cohesive ecosystem.Right now, Polkadot is arguably the frontrunner in this race, since there are now well over 350 projects being built on it.Boosting EfficiencyThe great majority of DeFi applications are currently built on Ethereum. While this means these projects benefit from arguably one of the most secure and well-developed blockchains in operation, they also inherit one of its biggest flaws – high fees.In the last six months, the fees on the Ethereum blockchain have reached successive highs, climbing to an average of $14.50 in September 2020, to $16.50 in January 2021, and finally to over $25 in early February 2021. And with Ethereum 2.0 still seemingly months or potentially years away from potentially bringing the fees down, a large number of DeFi projects have begun to look for alternatives.

Ethereum transaction fees over time. Photo: BitInfoCharts

A handful of high-throughput platforms have begun to establish themselves as hotbeds for DeFi applications, including Qtum and TRON – both of which offer similar functionality to Ethereum, albeit with drastically lower fees. However, they are both still firmly in the early stages of building out their respective DeFi ecosystems, but have already laid the groundwork for further growth.Right now, both platforms have their own automated market maker (AMM) platforms, e.g. Qtum’s QiSwap and TRON’s JustSwap, and the Qtum foundation recently announced a grant program for DeFi developers.With that said, it remains to be seen how these blockchains would perform if their DeFi ecosystem reaches the same scale as Ethereum’s.