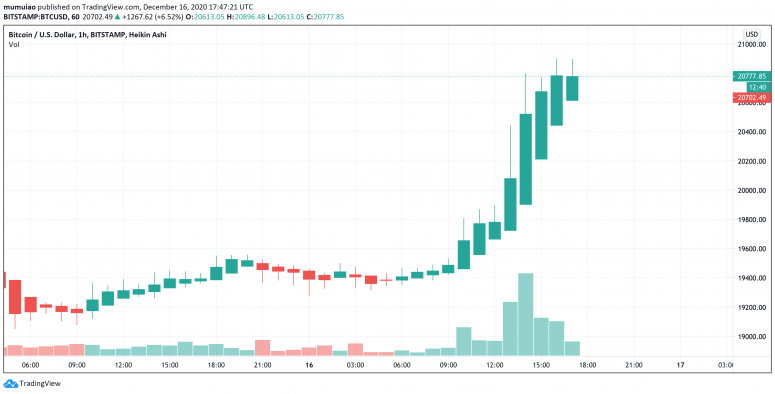

Bitcoin has continued trading higher Wednesday after breaking above the $20,000 level during early U.S. trading hours. Meanwhile, with a short supply of bitcoin and a surging demand, traders and analysts are optimistic the oldest cryptocurrency can keep its bull run going for a longer time.

- Bitcoin (BTC) trading around $20,808.28 as of 21:00 UTC (4 p.m. ET). Gaining 6.70% over the previous 24 hours.

- Bitcoin’s 24-hour range: $19,293.30-$20,890.11 (CoinDesk 20)

Bitcoin’s price continued higher after it hit the $20,000 threshold, and that is likely due to a combination of a rising demand and a shortage of supply.

“This bull run has been evidently driven by traditional financial institutions [that] have been actively buying bitcoin dips of late as an investment and treasury product. They have a long-term strategy for these assets,” Jason Lau, chief operating officer at San Francisco-based exchange OKCoin, told CoinDesk. “So with increased demand, HODLing and fewer block rewards due to the recent halving, the price may have no limits.”

Moments before bitcoin’s price broke $20,000 earlier Wednesday, on-chain data provider CryptoQuant’s chart captured an unusual spike in the number of stablecoin inflow addresses moving to all exchanges.

The increase in stablecoins going to exchanges usually means there is a strong buying power, according to Ki Young Jun, chief executive of CryptoQuant.

The surging demand came around the time U.K.-based Ruffer Investment confirmed to CoinDesk it bought about $744 million worth of bitcoin last month.

“We’re fast approaching a tipping point where more institutions make allocations as an inflation hedge,” Micah Erstling, a trader at GSR, said. “Each new big name instills further confidence in the market.”

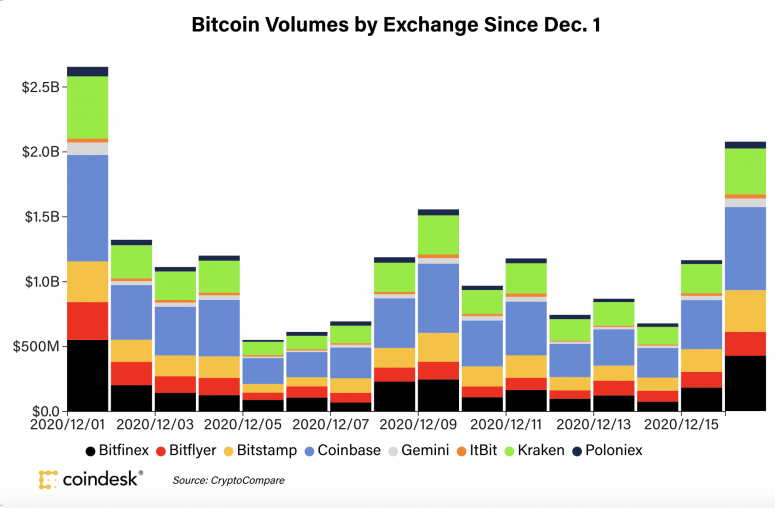

Bitcoin’s trading volumes on the eight major exchanges tracked in the CoinDesk 20 were also strong on Wednesday, at $2,075,614,385 as of press time, the second-highest volume in December after Dec. 1.

With bitcoin surpassing its highest level since its 2017 high, if the breakout keeps going for the next two days new resistance at around $25,000 could be possible.

“Because there is no additional resistance and targeted levels have been exceeded,” said Katie Stockton, a technical analyst for Fairlead Strategies, “we can use round numbers like $25,000 as gauges of potential resistance.”

Bitcoin’s options market also supports the widespread optimism on prices, according to Denis Vinokourov, head of research at the London-based prime brokerage Bequant. He noted that the most open interest for bitcoin is at $36,000 expiring in January.

“Although a rally of such magnitude is unlikely to be beneficial for overall market health,” Vinokourov said, “it would make the most sense to instead see price action around $19,500-23,000, which will be far better for long-term prospects.”

Ether May OutPerform Bitcoin On CME’s New ETH Futures

The second-largest cryptocurrency by market capitalization, ether (ETH) was Wednesday trading around $623.58 and climbing 5.47% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Analysts expressed their bullish attitude towards ether after the Chicago Mercantile Exchange (CME) announced it will launch a futures contract on ether in February 2021.

“Up until now, bitcoin has been the only crypto asset with publicly traded futures on a venue the caliber of the CME,” Vinokourov said. “With ether now also having this on-ramp, and having far more use cases than bitcoin, it would make sense for it to see exponentially higher growth than bitcoin.”

Although ether’s price is still less than half of its all-time high, the current rally could create a new resistance near $805, according to Stockton.

Other markets

There were very few losers on the CoinDesk 20 as of Wednesday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- litecoin (LTC) +8.75%

- xrp (XRP) + 8.07%

- cardano (ADA) + 5.91%

Notable losers:

- usdc (USDC) -0.12%

- kyber network (KNC) -0.12%

Equities:

- Asia’s Nikkei 225 ended the day up 0.26% after investors showed increased optimism over the prospect of more stimulus.

- The FTSE 100 in Europe closed in the green 0.9% as positive news came from the real estate market in the U.K. and about a possible post-Brexit trade deal.

- The S&P in the United States closed up 0.18% as more hopes grew an economic stimulus deal can be worked out in the Congress.

Commodities:

- Oil was up 0.48%. Price per barrel of West Texas Intermediate crude: $47.58.

- Gold was in the green 0.63% and at $1864.80 as of press time.

Treasurys:

- The 10-year U.S. Treasury bond yield climbed Wednesday to 0.92.