The rise of decentralized finance (DeFi) has been buoyed on trends like non-custodian lending, automated market making, and yield farming, which together, have opened newer possibilities for users to spend and use their cryptocurrency holdings, while even earning attractive interest rates.However, the market remains relatively opaque. The lack of order books, counterparty risk, smart contract bugs, among other criticisms, prevail and make it difficult for a newcomer to interact with DeFi apps as a first-timer, as opposed to using centralized crypto exchanges or wallets.But on-chain research and data provider IntoTheBlock is looking to change that. The firm announced the launch of its “DeFi Insights” analytics product on Wednesday, arming speculators and casual market participants with the tools they need to assess DeFi projects ahead of either investment or research purposes.As per the release, the tools cover both analytics about market segments such as lending or DEXes as well as for analytics about specific protocols such as UniSwap or Compound.

“This duality provides both a macro-insights about different market trends as well as in-depth specific analytics about a given protocol,” explained IntoTheBlock.

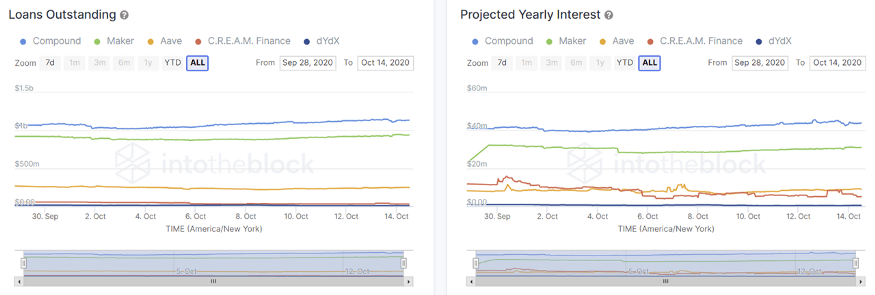

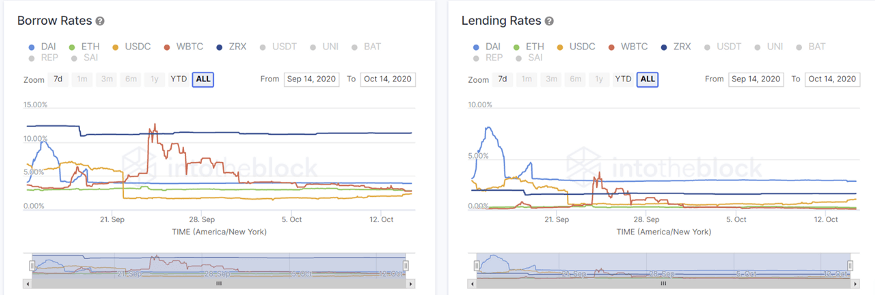

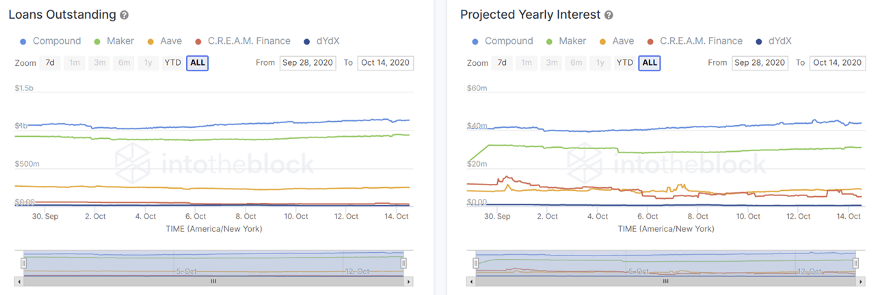

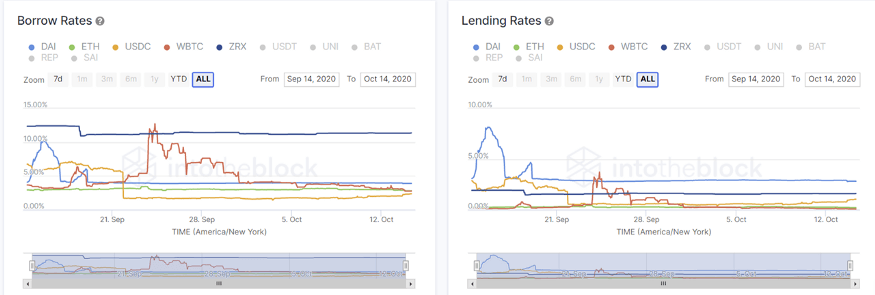

The IntoTheBlock DeFi analytics release is divided into two main sections: General Insights and “Explore by Protocol.”The General Insights section contains analytics about different segments of the DeFi market such as network, lending, or DEXes, the release said. “The goal is to allow users to rapidly compare indicators across different protocols in a specific area,” it added.An example is shown in the following chart, which compares outstanding loans across some of the top DeFi lending protocols: