Trading volumes and active addresses for bitcoin have now surpassed their previous all-time highs during the last crypto bull run in 2017, and the data has given some analysts confidence the bull market for bitcoin is not over yet.

- Data from CryptoCompare shows that bitcoin trading volumes on the eight major exchanges tracked on the CoinDesk 20 have passed $11 billion, a new all-time high from the previous record during 2017’s crypto bull market.

- “This is first and foremost a sign of how much bigger and mature the industry is, with a lot more money flowing on these exchanges,” Bendik Norheim Schei, head of research at Arcane Research, told CoinDesk. “It is great to see higher volumes, making the market more liquid and efficient.”

- The surging volume due to Monday’s sell-off came in part from newcomers to the market, according to Schei.

- “Some of this volume is definitely from new and unexperienced investors entering the market for the first time and panicking when the price starts falling,” he said. “These corrections are necessary and healthy, even in a bull market.”

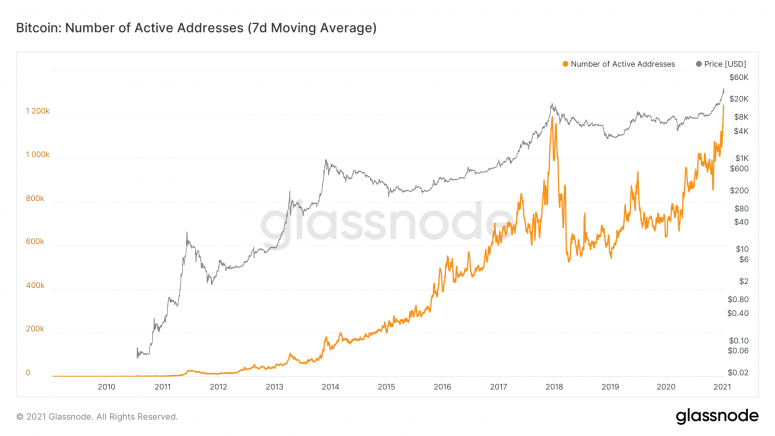

- At the same time, the number of active bitcoin addresses has also broke its previous record on Jan. 8, according to data from Glassnode.

- “At its highest point last week, over 1.3 million bitcoin addresses were active in a single day,” the on-chain data analytics firm wrote in its weekly market report on Jan. 11. “This continued spike indicates an impressive level of new adoption and activity for bitcoin, and suggests that the number of market participants in the network may be higher than ever before.”

- Bitcoin’s price was traded at $34,011.89, according to CoinDesk’s BPI, down 11.10% in the past 24 hours.

- Some said that the latest market sell-off was due to some short-term profit-taking by institutional investors, after prices went too high in the past week.

- Many have said bitcoin’s bull run since 2020 has been largely led by traditional institutions in North America, evidenced by the significant growth on the bitcoin’s futures market on the CME, which mainly serves institutional investors.