On Thursday, the leading cryptocurrency keeps correcting, declining to $34,738 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

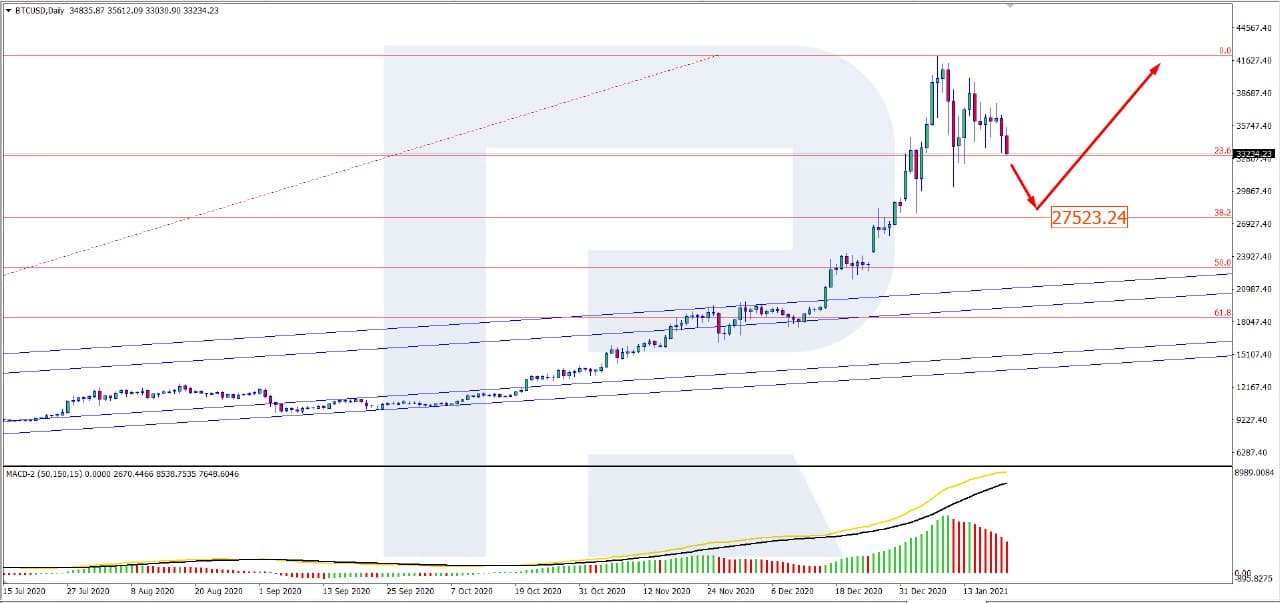

On W1, Bitcoin (BTC) continues to correct, aiming at the nearest support level of $27,523 USD. The MACD histogram remains positive, giving another signal for further growth. The signal lines of the indicator keep growing upon forming a Black Cross, which increases the chances for the development of the ascending dynamics. Meanwhile, the Stochastic rests in the overbought area, providing opportunities for further correction in the nearest future. From these factors, we can conclude that, upon breaking 23.6% Fibo, the asset might go on declining to 38.2%, and after the correction is over, the ascending impulse should continue.

Photo: RoboForex / TradingView

On D1, BTC/USD is developing a correction. The quotations have broken through 23.6% Fibo, aiming their decline at $27,523 USD. The MACD histogram is above zero, declining, which means the pullback might continue. The signal lines of the indicator are forming a Black Cross, supporting the correction. Judging by all the factors, the price should correct while growing towards the resistance level. The aim of the uptrend, as on the larger timeframe, is still $42,500 USD.

Photo: RoboForex / TradingView

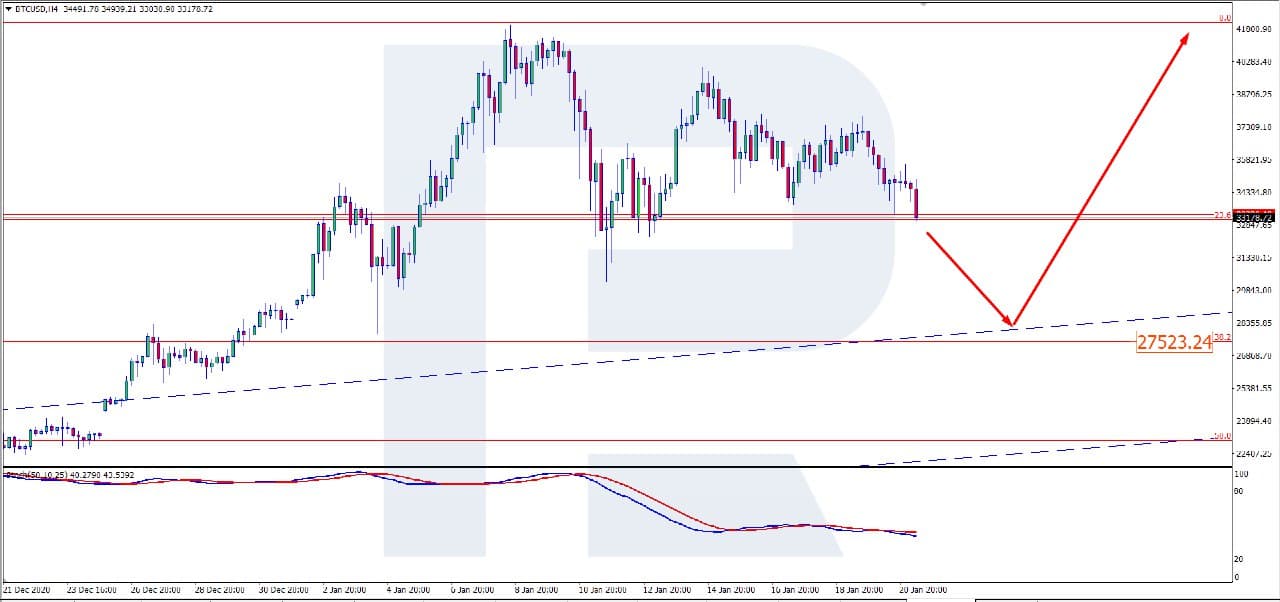

On H4, the correction looks highly probable. The Stochastic values are heading for the oversold area, which is yet another signal for a pullback. As on larger timeframes, the aim of the decline might be the support level near $27,523 USD. The aim of growth after the correction remains the same as before – $42,500 USD.

Photo: RoboForex / TradingView

The BlackRock investment company admits the probability of investments in cryptocurrencies, which provides the vastest perspectives for the market of digital assets. BlackRock manages various assets for 7.8 trillion USD. In its application to the SEC, BlackRock mentions the interest of two trusts in trading BTC futures. In BlackRock, they realize the risks of the low liquidity of such futures and the attitudes of the regulator but are ready to consider such a trading option.BlackRock had never before been interested in crypto but one of its top managers estimated the perspectives of the BTC as long-term even if the government takes the crypto market under control.The head of Pantera Capital – an investment company turned to the crypto market – Dan Morehead thinks that the price for the flagship cryptocurrency might rise to 115,000 USD by August, 2021. He does not call for relying solely on this scenario but highlights that currently the asset has all the chances for further growth. Until now, Pantera Capital has always given accurate predictions.For this article, we’ve used BTCUSD charts by TradingView.Disclaimer: Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.