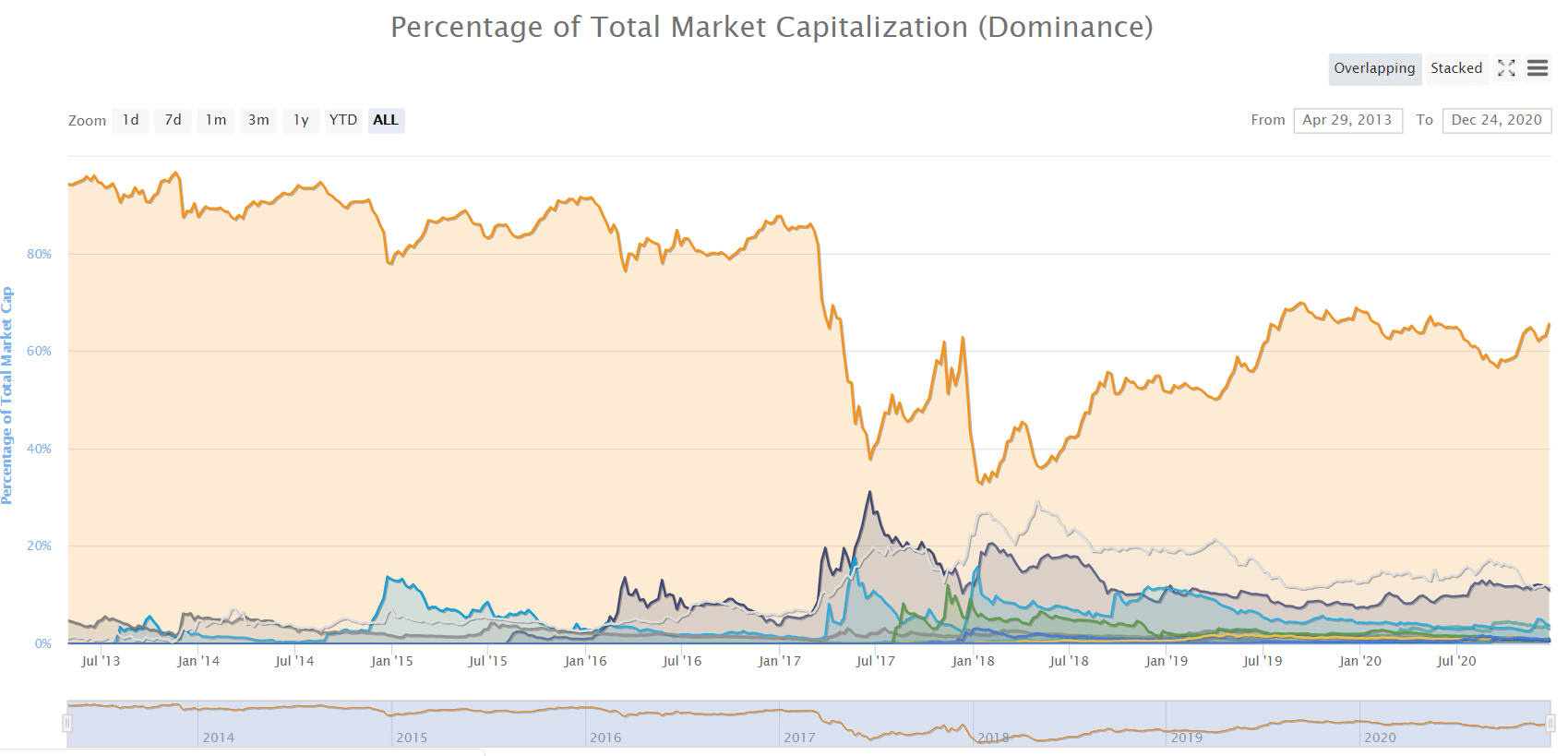

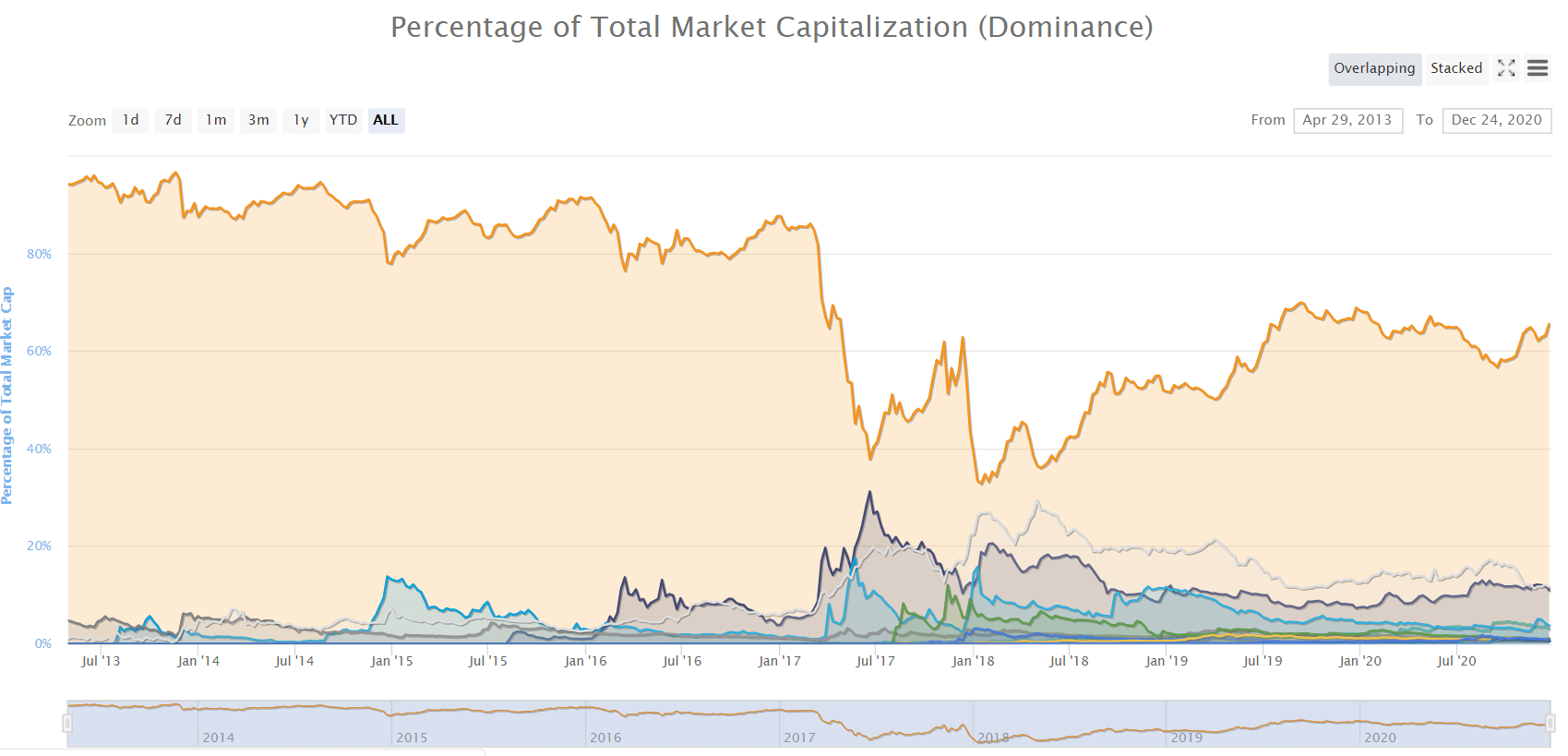

The world’s pioneer cryptocurrency has bounced back to glory after the DeFi summer stole much of the limelight.Bitcoin’s dominance rises to 68%As per data on tracking site CoinMarketCap, Bitcoin’s market share dominance is now at 66% after a long “DeFi summer” and a mini-alt season in October. These levels were last seen in 2019, and the years preceding 2017 before that. Bitcoin now makes up for 68% of the entire crypto market as a result, commanding a $433 billion market cap with a current circulating supply of over 18.5 million Bitcoin.

#Bitcoin dominance hitting yearly highs just now…at 69%

Last time we were 70%+ was March 2017

— Danny Scott (@CoinCornerDanny) December 23, 2020

The remaining market share is taken up with Ethereum (10%), Tether and XRP (3% each), Litecoin (1%), and Cardano (0.76%), among all large-caps cryptocurrencies.Bitcoin saw a temporary hit to both retail popularity and usage in Q2 of 2020 as decentralized finance (DeFi) coins, networks, and protocols saw increased interest and attracted investment from retail traders.

At some point in this #bitcoin bull market, we will likely see Central Banks panic sell gold for $BTC.

It may be surprising to Peter Schiff, but is not surprising to me at all that Gold cannot maintain its levels while Bitcoin is at ATHs. https://t.co/wrUzU84BxI

— Su Zhu (@zhusu) December 7, 2020

But the most defining purchase, arguably, has been that of enterprise software maker MicroStrategy. The firm has picked up over a billion dollars worth of spot Bitcoin since September in various tranches to hold in its treasury, with CEO Michael Saylor regularly tweeting about Bitcoin’s use cases since then.

#Bitcoin is the first engineered safe-haven asset running on the worlds’s first digital monetary network. As investors lose faith in Gold & Bonds as safe haven assets, it makes sense for all firms to have a Bitcoin strategy.https://t.co/kQ052tIeMG via @YouTube

— Michael Saylor (@michael_saylor) December 23, 2020

Such factors, coupled with a “supply-side crisis” as per on-chain analysts, have played their part in Bitcoin’s rise in 2020.