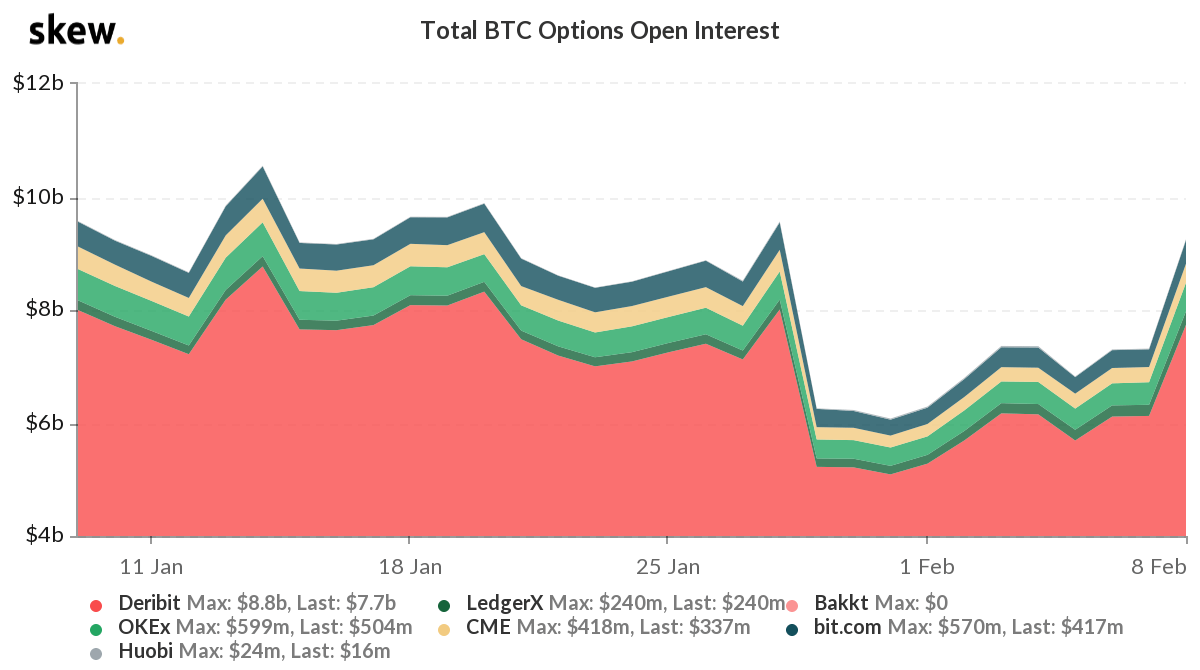

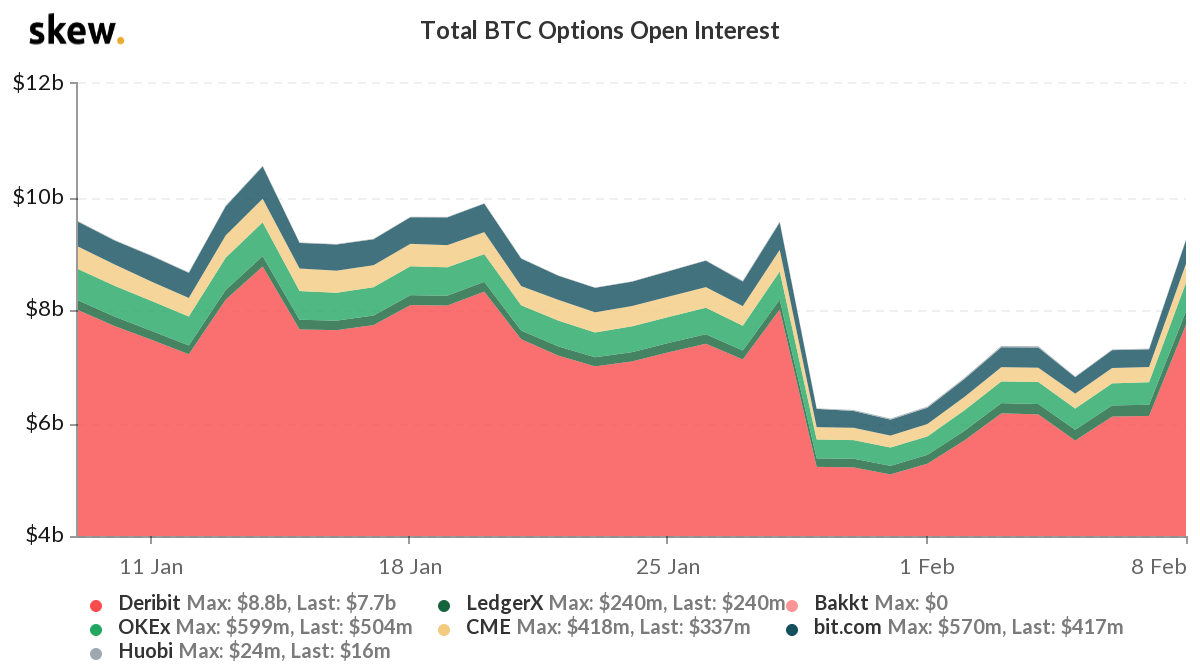

According to the data analytics platform Laevitas, the Bitcoin options market is seeing a “call buying frenzy.” This means that the buyer demand for BTC is rising rapidly in the form of options.The options market has seen significant growth in recent months. Data from Skew shows the total options market open interest has increased to over $7.7 billion.The high open interest of the options market means that if there is large options buyer demand, it could have a decent impact on the short-term price trend of Bitcoin.

“t’s a call buying frenzy on @DeribitExchange and @tradeparadigm Multiple 100+ contracts with strikes of 44k, 48k and 52k bought for February and March expiries for ~190 BTC ($8.4m).”

In the past, it was uncertain whether the options market has a material effect on the price of Bitcoin.Throughout the past six months, the options market open interest has at times nearly reached party with the futures market open interest. As such, with the call options volume rising this steeply, the massive buyer demand for BTC would likely be sustained.

“At least 6% of all Bitcoin, over $50 Billion, is already in corporate treasuries. The real number including unreported private companies, VCs, etc, is probably at least 2x that and growing!”

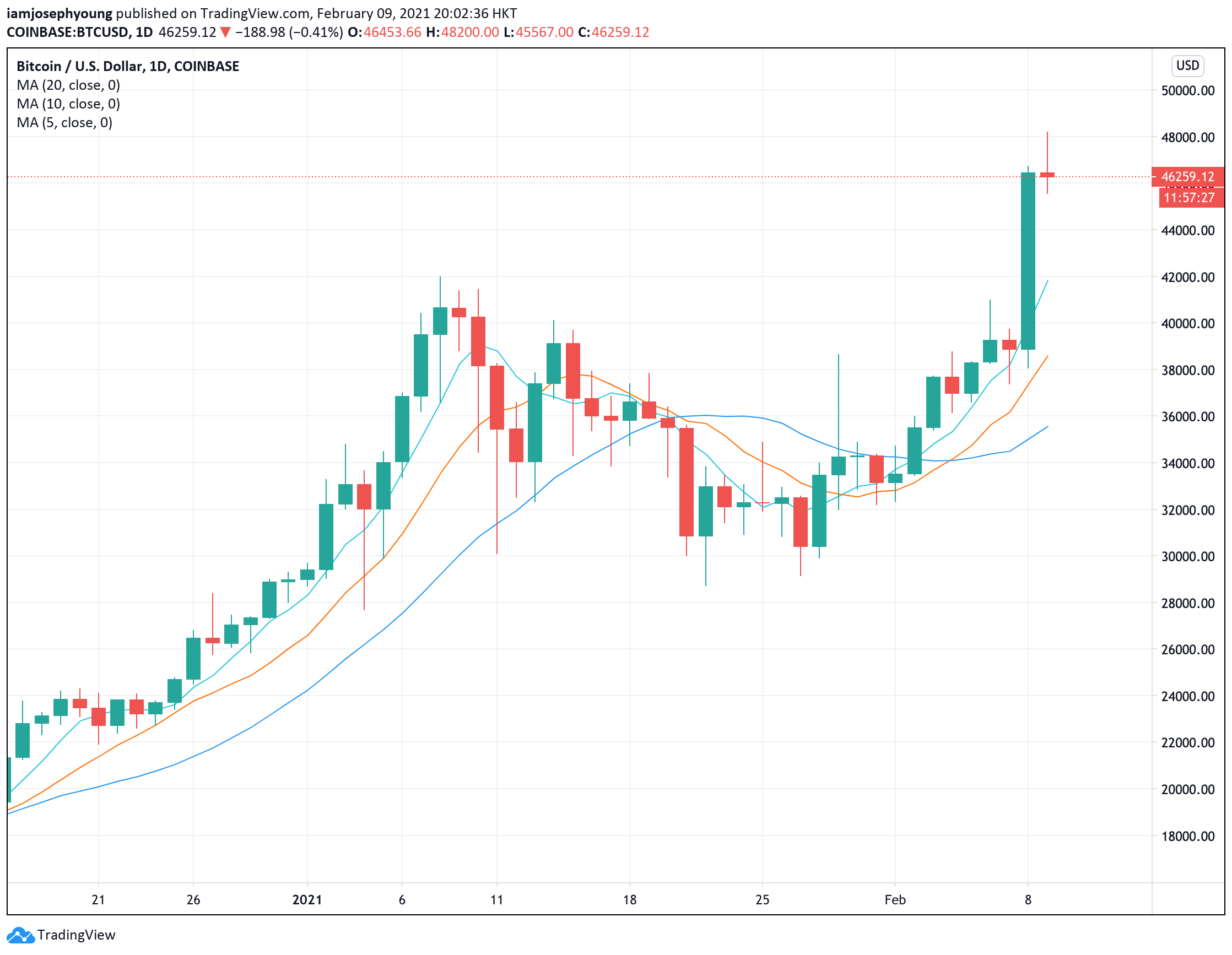

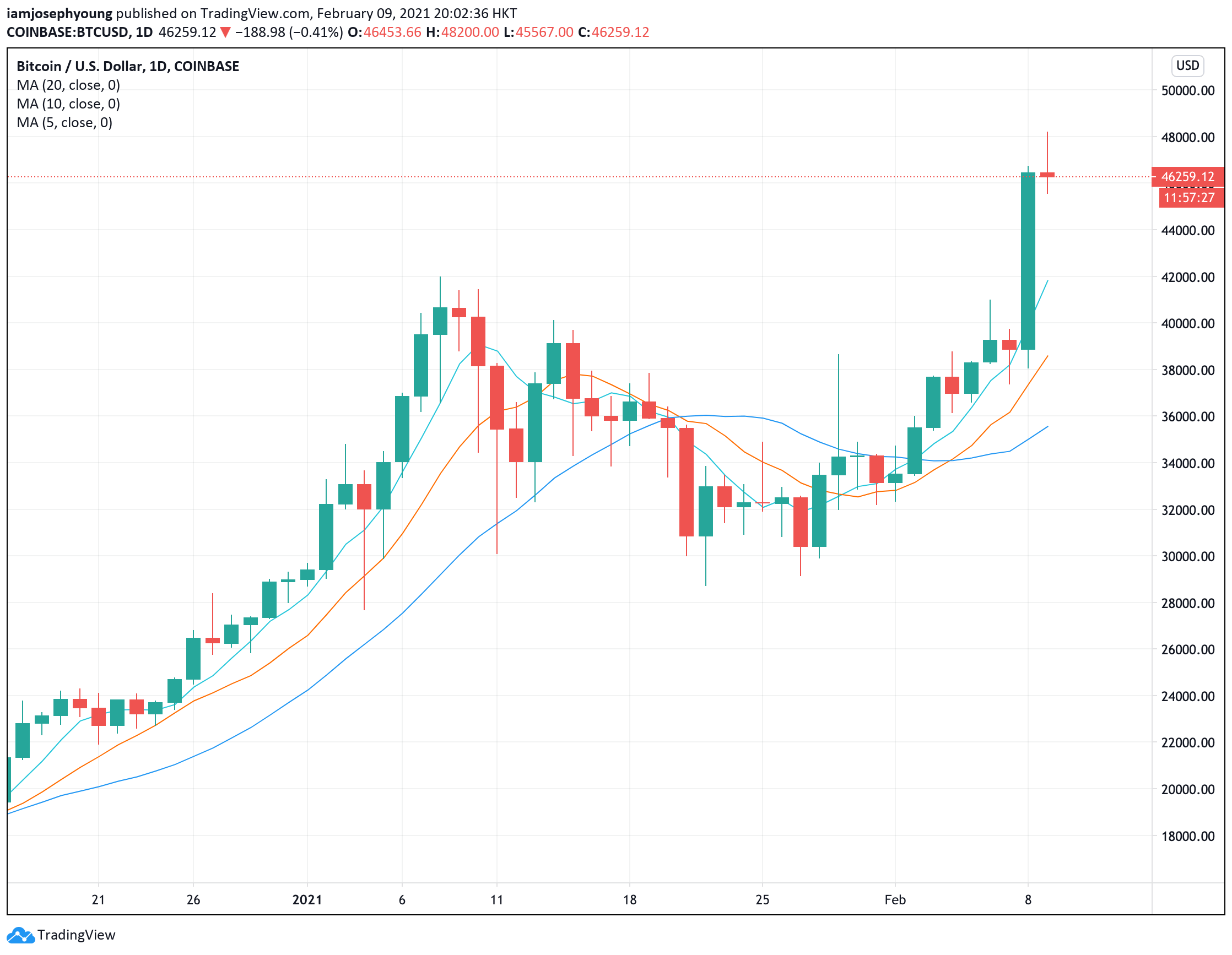

But, there is one risk in the Bitcoin market in the near term. The funding rate of the futures market is increasing to dangerous levels, which could trigger a long squeeze.A long squeeze occurs when the futures market is dominated by longs or buyers. When a minor drop occurs, this could cause overleveraged longs to get liquidated in quick succession.When the funding rate is this high, which is currently hovering at around 0.25%, the probability of a massive long squeeze sharply increases. In the short term, the ideal scenario would be for the funding rate of BTC to decline as it consolidates, resetting the overleveraged market.